Advertisement|Remove ads.

DECK Stock Jumps 11% – Wall Street Mixed On Q3 Earnings, Retail Goes Contrarian

- Stifel analyst Peter McGoldrick increased his price target on the stock and cited solid upside in the seasonally important Q3 period, noting balanced growth and strong margins.

- Piper Sandler lifted its price target to $95 from $85 but maintained an ‘Underweight’ rating, cautioning about demand.

- Goldman Sachs praised HOKA's brand growth and UGG's better-than-expected performance.

Deckers Brands (DECK) is attracting analysts' attention following its fiscal third-quarter (Q3) results, with several firms adjusting price targets amid strong seasonal performance and trends across key brands.

The company reported Q3 revenue of $1.96 billion and earnings per share (EPS) of $3.33, both above the analysts’ consensus estimates of $1.08 billion and $2.77, respectively, according to Fiscal AI data.

Street’s Mixed Opinion

Stifel analyst Peter McGoldrick increased his price target on Deckers to $140 from $117 and retained a ‘Buy’ rating, according to TheFly. He cited solid upside in the seasonally important Q3 period, noting balanced growth and strong margins.

The analyst called FY26 guidance “a low bar” and raised 2027 estimates, commending the company’s execution and improving trends. Piper Sandler lifted its price target to $95 from $85 but maintained an ‘Underweight’ rating. The firm highlighted Q3 outperformance and an upward revision to FY26 guidance but expressed caution over forward demand.

Goldman Sachs raised its price target to $92 from $81 while keeping a ‘Sell’ rating. The firm praised HOKA's brand growth and UGG's better-than-expected performance. Despite year-over-year (YoY) gross margin pressure, results surpassed expectations due to reduced tariff impacts, effective pricing, and less promotional reliance.

Wells Fargo increased its price target to $110 from $95 and retained an ‘Equal Weight’ rating. The firm acknowledged the strong Q3 beat, but noted concerns about limited U.S. growth, margin pressures, and rising competition in the athletic footwear segment.

Deckers Outdoor stock traded over 11% higher on Friday morning.

Stocktwits Users’ Optimism

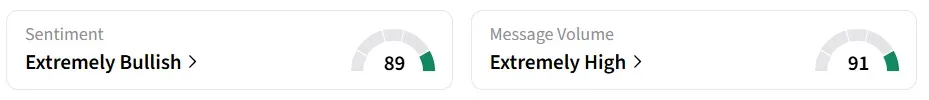

On Stocktwits, retail sentiment around the stock jumped to ‘extremely bullish’ from ‘bearish’ territory the previous day. Message volume improved to ‘extremely high’ from ‘normal’ levels in 24 hours.

The stock saw a 955% increase in retail chatter over the past 24 hours. A Stocktwits user believes the company will overtake Nike in five years.

Another bullish user said DECK competes in performance with HOKA while leading a highly profitable lifestyle category with UGG.

DECK stock has declined by 49% in the last 12 months.

Also See: MSFT Stock Tumbled On Thursday – But Retail Sees The Decline As A Gift To Investors

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262712431_1_jpg_6f471d2542.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259503553_jpg_13fb8f2e88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)