Advertisement|Remove ads.

Devon Energy Stock Rises Aftermarket On Q4 Profit Beat, Fuels Retail Euphoria

Devon Energy (DVN) shares rose 1.1% in aftermarket trade on Tuesday after the company’s fourth-quarter earnings topped Wall Street’s estimates.

The oil and gas producer reported core earnings of $756 million, or $1.16 per share, for the quarter ended Dec. 31. According to FinChat data, analysts, on average, expected the company to post $1 per share.

The company’s fourth-quarter production surged to 848,000 barrels of oil equivalent per day (boepd), compared with 662,000 boepd in the year-ago quarter.

The uptick in production came from its $5 billion deal for Grayson Mill, which lifted Devon’s production from the Williston Basin by 117,000 boepd during the quarter. Its production from the Eagle Ford basin also rose, helped by strong well productivity.

According to the U.S. Energy Information Administration data, U.S. oil production hit a new record high in 2024, as technological advancements helped producers drill longer wells and maximize output.

However, the company’s realized oil prices without hedges fell to $68.11 per barrel from $77.32 last year. This was offset by a rise in natural gas liquids and natural prices.

Its production costs, including taxes, averaged $11.30 per boe in the fourth quarter, a decline of 1% from the prior period.

Devon expects 2025 production to be between 805,000 and 825,000 boepd, a 2% increase from the company’s previous outlook.

The Oklahoma City-based expects capital spending between $3.8 billion and $4 billion in 2025, a 5% decline from its previous projections at midpoint.

It raised its quarterly dividend by 9% to $0.24 per share.

Devon CEO Rick Muncrief is expected to step down during the first quarter and hand over the reins to the company’s chief operating officer, Clay Gaspar.

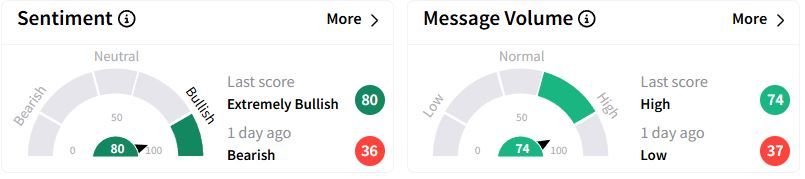

Retail sentiment on Stocktwits jumped to ‘extremely bullish’ (80/100) territory from ‘bearish’(36/100) a day ago, while retail chatter rose to ‘high.’

One user saw a 25% upside by June for the stock.

Over the past year, the Devon stock has fallen 19%.

Also See: EQT Stock Rises After Hours On Q4 Beat — Retail's Feeling The Energy

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260447662_jpg_cd246b74f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2254924116_jpg_d54ffea07e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228900989_jpg_e94daec744.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)