Advertisement|Remove ads.

Discover Financial Stock Hits Fresh All-Time High After Q4 Profit More Than Triples, Retail’s Elated

Discover Financial Services (DFS) stock rose 3.2% to hit an all-time high on Thursday after the company’s quarterly profit more than tripled.

On Wednesday, the company reported a net income of $1.29 billion, or $5.11 per share, for the fourth quarter, compared with $366 million, or $1.45 per share, for the same period last year.

Its net interest income (NII) rose 5% to $3.63 billion, driven by an expansion in the net interest margin compared to last year.

The Riverwoods, Illinois-based company's net interest margin was 11.96%, up 98 basis points compared to last year, benefiting from the sale of its student loan portfolio.

Discover Financial said total loans ended the quarter at $121.1 billion, down 6% year-over-year, but credit card loans rose 1% to $102.8 billion.

The lender’s digital banking pretax income jumped to $1.6 billion for the quarter, reflecting a lower provision for credit losses and increased revenue net of interest expense, partially offset by higher operating expenses.

Discover Financial sold a portfolio of student loans to private equity firms Carlyle and KKR in 2024 for up to $10.8 billion.

The bank’s provision for credit losses declined by 37% to $1.2 billion.

The company said its payment services pretax income rose 37% to $74 million, primarily due to volume growth and the timing of incentives.

Capital One, which had agreed to buy Discover Financial for $35.3 billion last year, also reported an uptick in fourth-quarter earnings on Tuesday.

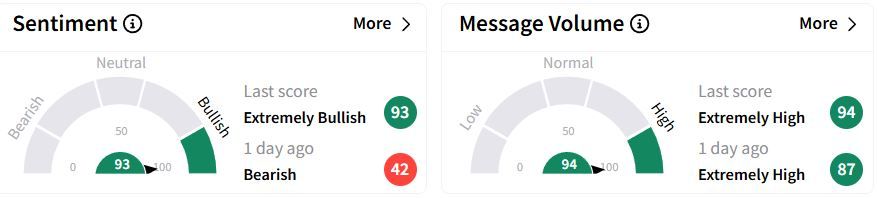

Retail sentiment on Stocktwits flipped to ‘extremely bullish’ (93/100) territory from ‘bearish’(42/100) a day ago to hit year-high levels, while retail chatter remained ‘extremely high.’

Users also set fresh price targets for the stock.

Over the past year, the stock has more than doubled in value.

Also See: Northern Trust Stock Rises After Q4 Profit Quadruples, Retail’s Ecstatic

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)