Advertisement|Remove ads.

Dixon Technologies Under Pressure: SEBI RAs Flag Caution As Motorola Exit, Promoter Stake Sale Weigh On Retail Sentiment

Dixon Technologies shares fell 3% on Wednesday after brokerage firm Phillip Capital revised its target lower to ₹9,085, implying a 37% downside. They maintained a ‘Sell’ rating, citing increased competition pressures.

This comes after Dixon’s largest client, Motorola, ended its exclusive partnership with the company and outsourced its domestic production to Karbonn.

SEBI-registered analyst Dhwani Patel observed that the stock continues to exhibit weakness within a descending triangle pattern, marked by lower highs and horizontal support near ₹12,754.

Dixon Technologies stock is trading below its 20 Exponential Moving Average (EMA) of ₹14,583, 50 EMA (₹14,868), and 200 EMA (₹14,284), indicating bearish control across all timeframes.

Patel highlighted that the Directional Movement Index (DMI), an indicator that helps determine the strength and direction of a stock, confirmed a bearish momentum, though the Average Directional Index (ADX) at 20.7 suggests a weak trend.

She believes that a breakdown below ₹12,754 could lead to further downside toward ₹12,000 or even ₹11,200. On the contrary, a breakout above ₹14,900, crossing both the upper trendline and key EMAs, could trigger a bullish reversal toward ₹15,800–₹16,500.

Until such confirmation, she observed that the bias remains negative with a watchful eye on volume and price action near critical zones.

Earlier this week, Sunil Vachani, promoter of Dixon Technologies, sold nearly 2.77% of his stake in the open market for around ₹2,200 crore. Analyst Nikhil Gangil highlighted that this follows earlier stake reductions of about 2% over the years.

He added that despite Dixon reporting cumulative profits of just over ₹2,500 crore over the last 11 years, retail investors have continued to drive the stock to elevated levels, with valuations stretching to nearly 29 times its book value.

Gangil noted that retail investors are bullish on Dixon, due to its leadership in India's contract manufacturing and electronics story, with impressive growth of revenues rising over five times in FY25 and profits surpassing ₹1,200 crore.

However, he cautioned that the recent stake sale at peak valuations raises some questions. With Dixon trading at 29 times book value and over 60 times earnings, any disappointment could trigger a sharp de-rating.

Gangil shared that several listed manufacturing and industrial stocks are trading at lower valuations, with similar or better growth visibility. While Dixon remains a leader with strong execution, its current valuation requires consideration, he added. Insider stake reductions often serve as a signal for reassessment.

He concluded that even good companies can be bad investments if entered at the wrong price. Gangil advises retail investors to remain cautious on Dixon.

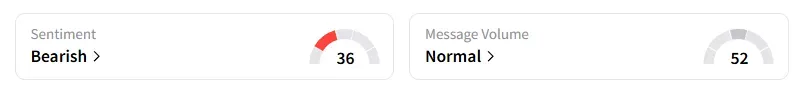

Data on Stocktwits shows that retail sentiment turned ‘bearish’ earlier this week on this counter.

Dixon Technologies shares have fallen 21% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Git_Lab_resized_49b70b74d0.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_moderna_covid_jpg_3eb7363e71.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_6549f7641a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234227546_jpg_b7fa546ca4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_digitalpayments_resized_png_5e564e753b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2208385583_jpg_9511ec9642.webp)