Advertisement|Remove ads.

Trump Media Stock Seizes Retail Spotlight With Impressive 160% Monthly Surge As Election Nears

Shares of Trump Media & Technology Group Corp. ($DJT), the parent company of Truth Social, rose over 7% pre-market Monday, making it the top trending ticker on Stocktwits.

With a remarkable 163% surge in October, the stock has returned to levels not seen in over three months.

Donald Trump, the Republican presidential candidate, holds approximately 57% of the company’s stock, and sentiment surrounding his political activities significantly influences DJT’s performance.

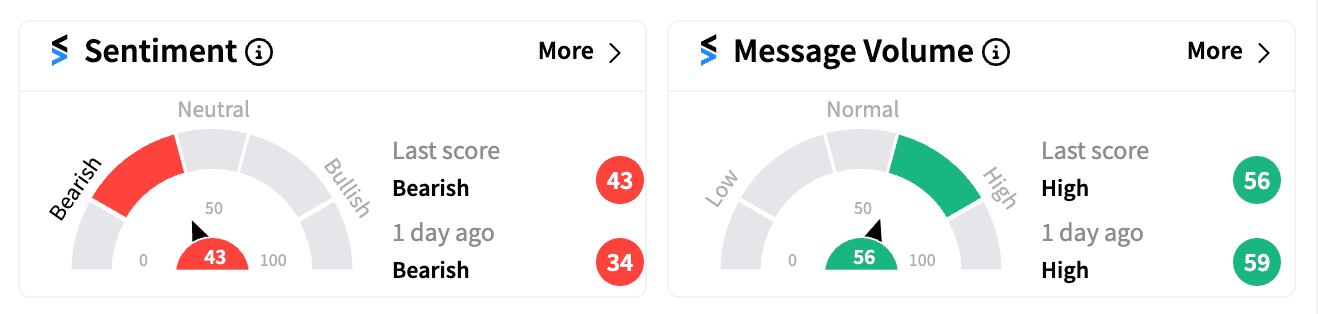

Stocktwits sentiment remained ‘bearish’ (43/100) ahead of Monday’s market open, with many skeptics voicing concerns about potential declines if Trump loses in the upcoming presidential election.

Several polls have shown Trump regaining a slight lead over Democratic candidate Kamala Harris, though some still indicate Harris maintaining a narrow advantage.

As reported by the Wall Street Journal, Trump’s stake in the company is currently valued at about $4 billion, which has helped offset losses from his real estate holdings.

His net worth is reportedly estimated between $7.5 billion and $10 billion, significantly higher than in 2020 and 2016, buoyed by the value of Truth Social and the performance of his golf properties.

The DJT stock has seen an explosive growth in retail interest, with followers on Stocktwits skyrocketing by 221 times over the past year and a 36% increase in message volume last week.

However, the stock’s rise comes amid internal turmoil, with reports of at least three senior managers being dismissed or pushed out recently.

Employees have sent a letter to the Trump Media board accusing CEO Devin Nunes of mismanagement, criticizing his directive to hire foreign contractors as inconsistent with the company’s “America First” principles, the New York Times reported, citing people familiar with the matter.

The letter also highlighted a lack of communication from Nunes, who has allegedly not addressed staff in two years.

Despite the October rally, DJT’s stock is still down about 35% since its SPAC merger in March, affected by disappointing financials, insider selling, Trump’s ongoing legal challenges, and uncertainty regarding his electoral prospects.

With just a week to go for the Nov. 5 presidential election, DJT and other Trump-linked stocks, such as Phunware ($PHUN) and Rumble ($RUM), are also experiencing increased attention from investors.

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)