Advertisement|Remove ads.

Trump Media Stock Set To Snap 3-Day Rally As Retail Grows Bearish Amid Election Tensions

Shares of Trump Media & Technology Group Corp. ($DJT) slid over 15% Wednesday morning, setting them on a path to cut short a three-day rally.

The stock, which has been on top most-discussed tickers Stocktwits over the past few days, has sparked high interest as the 2024 U.S. presidential race between Donald Trump and Vice President Kamala Harris intensifies.

Trump holds around 114 million DJT shares or 57% of the company, whose stock has tripled in value over the past month.

Tuesday’s session saw a temporary halt in trading before the stock closed up 8%, marking its best finish since the end of May.

Vice President Harris on Tuesday issued a striking challenge to Americans, urging them to “turn the page” on Trump’s influence over U.S. politics.

In her closing remarks, Harris cited Trump’s behavior during the Jan. 6 Capitol insurrection, arguing he is unfit for office.

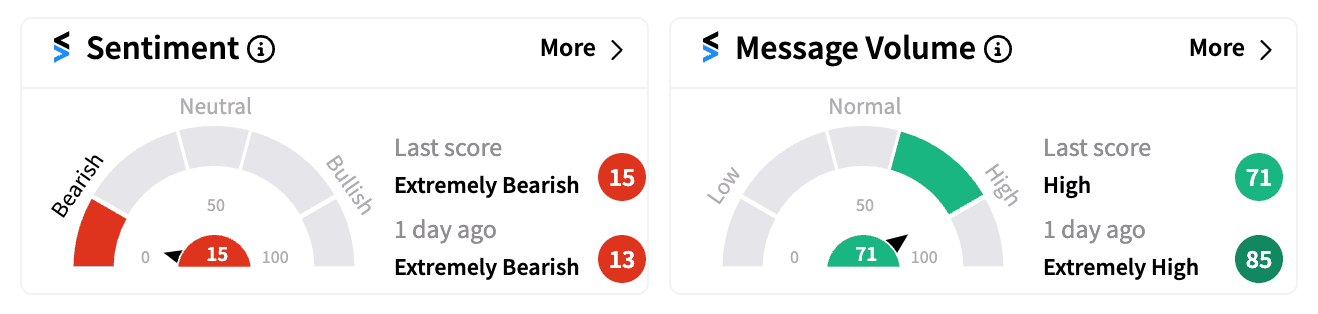

Retail sentiment on Stocktwits remained ‘extremely bearish’ (15/100) Wednesday as of 11 a.m. ET.

While some investors voiced optimism over the rally, skeptics have highlighted the stock’s limited financial fundamentals.

The company generated just $770,500 in first-quarter revenue primarily from its early-stage advertising efforts and has yet to report its second and third-quarter earnings amid internal challenges.

The stock’s elevated short interest also looms large, with S3 Partners reporting 14.5 million shares are shorted, which represent roughly 17% of the float.

“This elevated short interest has raised concerns of a potential squeeze, as election-driven volatility intensifies,” it said on Tuesday.

The options market is now pricing in a possible 50% price swing, according to the research firm.

DJT’s current valuation currently exceeds $10 billion.

CNBC reported on Tuesday that as of the last session’s close, Trump’s stake in DJT has ballooned to nearly $6 billion, and he has entered “this election nearly twice as wealthy as he was in the last two elections.”

If elected, Trump could reportedly become the wealthiest U.S. president to control a publicly traded company while in office, a role largely exempt from conflict-of-interest rules.

Despite the recent rally, DJT remains down over 27% from its post-SPAC merger levels.

For updates and corrections, email newsroom@stocktwits.com

Read next: ASP Isotopes Stock Rockets As TerraPower Deal Ignites Retail Buzz

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)