Advertisement|Remove ads.

Trump Media Stock Surges After President-Elect Says 'No Intention' Of Cutting Stake: Retail Opts For Caution

Shares of Trump Media & Technology Group ($DJT) surged more than 10% on Friday after President-elect Donald Trump took to Truth Social to quell rumors that he intended to sell his stake in the company.

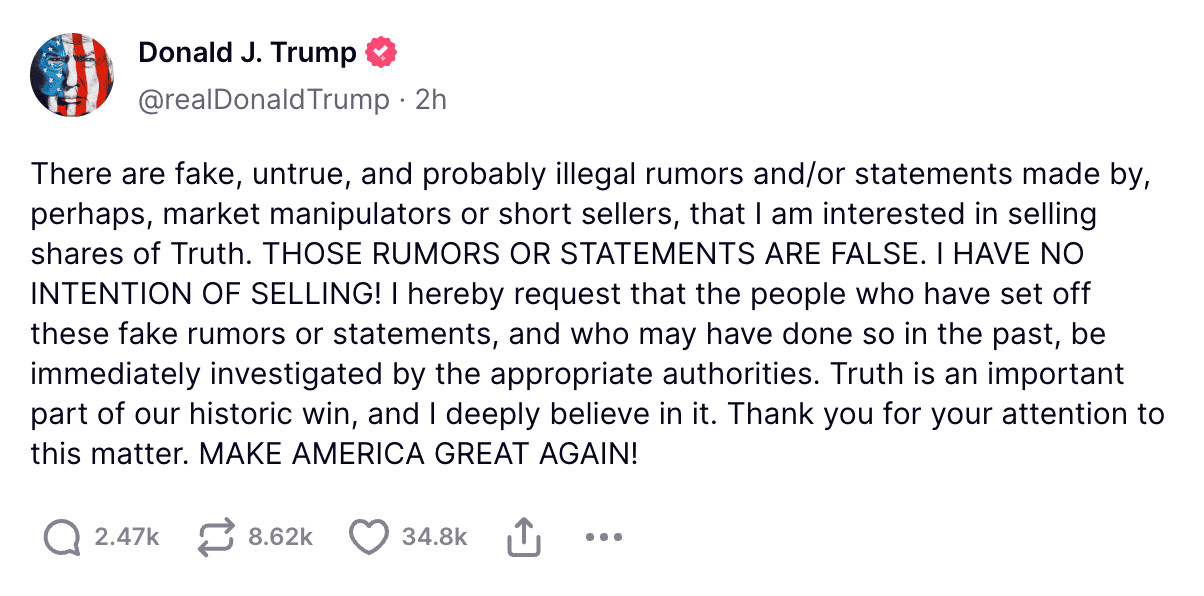

In a post, Trump denied the claims, labeling them as “fake, untrue, and probably illegal,” and requested investigations into the parties responsible for spreading the rumors.

He emphasized that Truth Social remains a crucial part of his legacy and reaffirmed his commitment to the platform.

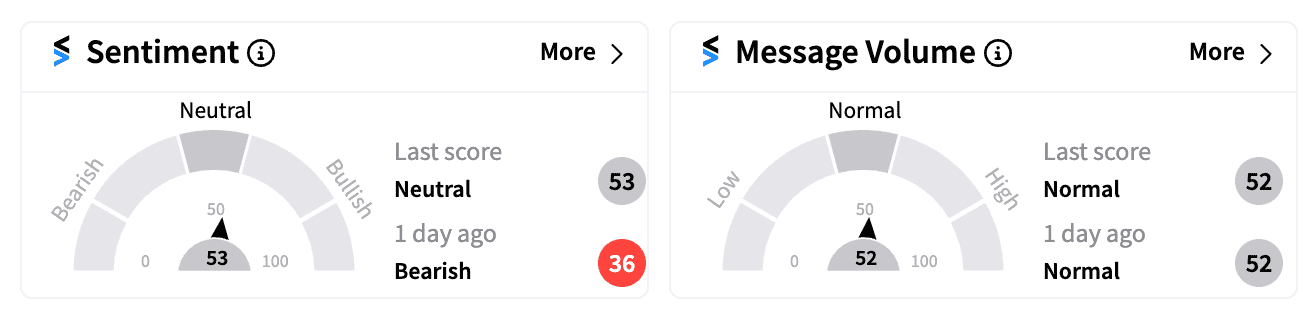

Despite the rally, retail sentiment on Stocktwits remained ‘neutral,’ with some investors being hopeful of further gains for the stock.

However, there were also concerns about recent insider selling.

Trump Media CFO Phillip Juhan had recently adopted a Rule 10b5-1 trading plan, allowing him to sell up to $12 million worth of shares between November 2024 and December 2025.

This raised some skepticism about the company’s future prospects, as Juhan’s planned sale involves 400,000 shares, valued at around $12.2 million.

Trump, who is the majority shareholder with a 57% stake in DJT, had previously stated that he would not sell his shares, even when the stock was at recent lows.

Following the post-election stock surge, Trump’s net worth has reportedly hit nearly $6.5 billion, with more than half of that tied to his stake in DJT.

Despite the strong Friday performance, analysts have raised concerns over the stock’s overvaluation.

The company, which has a market capitalization over $5.5 billion, reported only $1 million in third-quarter sales, leading many to believe the stock “is defying gravity”.

In a broader market context, J.P. Morgan reportedly noted that retail investors turned from net buyers to net sellers across the media and entertainment sector, including Trump Media, citing concerns about overvaluation in these stocks.

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)