Advertisement|Remove ads.

Domino's Pizza Stock Stumbles After Mixed Q4 Earnings: Retail Sentiment Goes Stale

Shares of Domino’s Pizza fell more than 1.5% on Monday and slipped further after the closing bell following mixed quarterly results from the fast food chain, dampening retail sentiment.

Domino’s fourth-quarter earnings per share came in at $4.89, missing estimates of $4.90. Revenue stood at $1.44 billion, below Wall Street’s expected figure of $1.47 billion. Its Q4 U.S. same store sales were up 0.4% and international SSS increased by 2.7%.

"Domino's 2024 results demonstrated that our Hungry for MORE strategy can drive strong order count growth, even in the face of a challenging global macroeconomic environment," said Russell Weiner, Domino's CEO.

CFO Sandeep Reddy reportedly didn’t factor in any potential impact of Trump tariffs in the company’s outlook, saying the company sources most of its food products from the U.S. itself, MarketWatch reported.

Following the results, Barclays raised the price target to $420 from $402 with an ‘Underweight’ rating, Fly reported. The firm noted the company’s “mixed” results, with the primary focus being the below expectations of U.S. comp growth.

According to Barclays, Domino's 2024 challenges will likely continue into 2025, with assumptions for U.S. comp accelerating and international declining.

Stifel analyst Chris O'Cull also raised the firm's target price to $500 from $470 with a ‘Buy’ rating. According to Stifel, Domino's continues leveraging its "value leadership" to drive share gains in a "highly competitive" quick service restaurant environment.

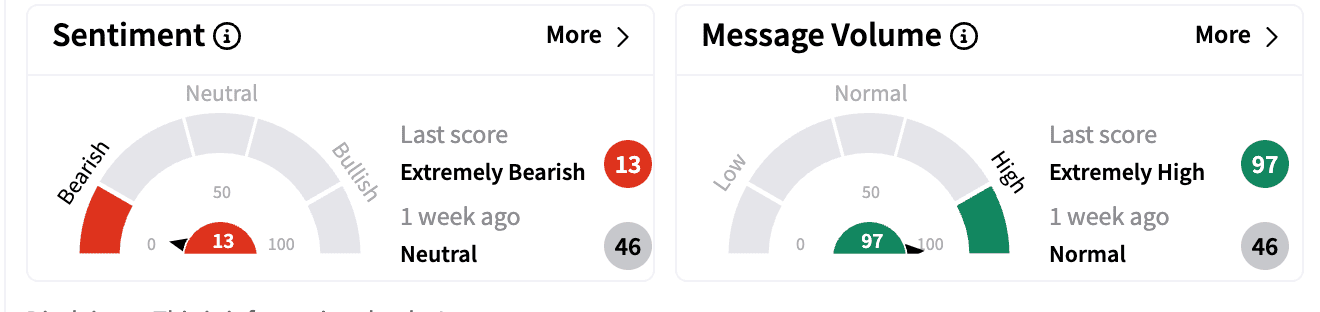

However, sentiment on Stocktwits turned ‘extremely bearish’ from ‘neutral’ a week ago. Message volume jumped to ‘extremely high.’

The company's board also approved a 15% increase to its per share quarterly dividend and a $1.74 per share quarterly dividend on its outstanding common stock for shareholders of record as of March 14 to be paid on March 28.

Berkshire Hathaway recently boosted its holdings in Domino’s Pizza by 1.1 million shares in the fourth quarter, worth about $450 million.

Domino’s Pizza stock is up 8.6% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)