Advertisement|Remove ads.

DoorDash, Dollar General Announce Partnership But Retail’s On The Sidelines

Shares of DoorDash (DASH) and Dollar General (DG) were in the spotlight on Tuesday after the two announced a partnership to bring payment capabilities to the latter’s stores, but retail sentiment remained subdued.

With this tie-up, DoorDash will bring payment services to more than 16,000 of Dollar General's stores on the DoorDash Marketplace, according to the two companies.

With the addition of Dollar General, DoorDash's network that accepts online payments in the SNAP/EBT mode on the DoorDash Marketplace nearly doubles to over 35,000 stores, the company said.

"Dollar General's mission of serving others includes helping customers save time and money everyday. Unlocking the ability for SNAP/EBT recipients to shop online and have groceries delivered straight to their door through DoorDash provides even more accessibility and convenience," said Tony Rogers, SVP and CMO at Dollar General.

Rogers added that with about 75% of the U.S. located within five miles of a DG store, the partnership will enhance its services.

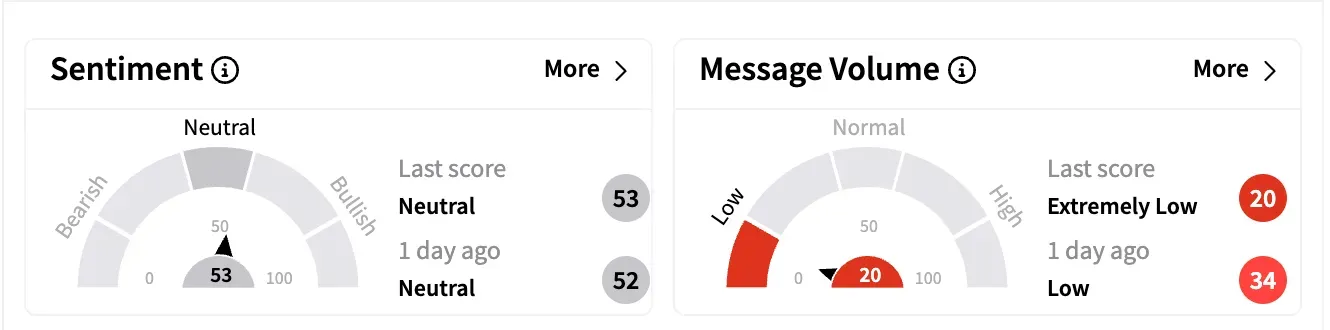

Sentiment on Stocktwits was subdued, however, ending neutral on Tuesday. Message volume was in the ‘extremely low’ zone.

DASH sentiment meter and message volume on March 18 as of 2 am ET

One bearish watcher of DoorDash questioned if the “current recession” has been priced in.

DoorDash shares were on watch recently following its addition to the S&P 500. The company is set to join four other stocks by the end of the month.

For its most recent quarter, DoorDash’s revenue stood at $2.87 billion, rising 25% year-on-year, beating consensus estimates of $2.85 billion.

DoorDash stock is up 10% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236199359_jpg_28b0018e3a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199401088_jpg_656c1eacd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_wall_street_sign_resized_f75f6c0a63.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_e90331e6a6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2210921290_jpg_46bb1e6211.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_figma_original_jpg_90603f536b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)