Advertisement|Remove ads.

DoorDash Stock Rises After Q4 Revenue Beats Street Expectations: Retail’s Extremely Bullish

Shares of DoorDash Inc. ($DASH) rose 5.7% in after-hours trading on Tuesday after the company smashed Wall Street expectations on its fourth-quarter revenue, lifting retail sentiment.

However, DoorDash’s earnings per share came in at $0.33, below Wall Street estimates of $0.34, according to Stocktwits data.

Revenue for Q4 stood at $2.87 billion, rising 25% year-on-year, beating consensus estimates of $2.85 billion. The increase was driven primarily by growth in its marketplace gross order value and advertising revenue growth. Net revenue margin was 13.5% in Q4 compared to 13.1% in Q4 2023, the company said.

For Q1, 2025, DoorDash sees Q1 adjusted earnings before interest, taxes, depreciation and amortization (Ebitda) between $550 million and $600 million. GOV is expected between $22.6 billion and $23 billion.

"Our approach to building DoorDash is based on a mix of deep commitment to our customers, focus on improving our operational efficiency, belief in the value of scale, and ambition to do much more for local economies in the future than we do today. In 2024, we grew revenue 24% year-over-year, generated our first full year of positive GAAP net income, and helped generate nearly $60 billion in sales for local merchants in over 30 countries and over $18 billion in earnings for Dashers,” the company said.

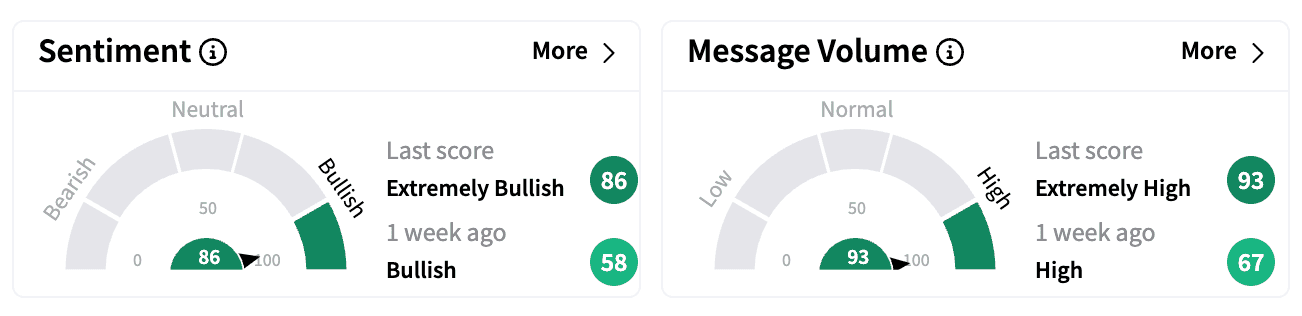

Sentiment on Stocktwits improved to ‘extremely bullish’ compared to ‘bullish a week ago. Message volumes jumped to ‘extremely high’ zone from ‘high.’

Founded in 2013, DoorDash is a local commerce platform dedicated to enabling merchants to play in the convenience economy.

DoorDash stock is up 15% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)