Advertisement|Remove ads.

DoorDash Completes $3.9B Deliveroo Acquisition: Retail Traders Upbeat

DoorDash has completed the acquisition of the UK's Deliveroo, the American food delivery company announced early Thursday, sending its shares marginally higher in premarket trading.

The $3.9 billion deal, DoorDash's second-largest after its $8 billion purchase of Finnish food-delivery company Wolt in 2022, substantially expands DoorDash's presence in Europe. The UK and Ireland account for about 60% of Deliveroo's total revenue, while France and Italy are also large markets for the company.

Notably, DoorDash's shares have gained about 9% since the deal was announced on July 1, and about 60% year-to-date. The stock currently trades near a record high.

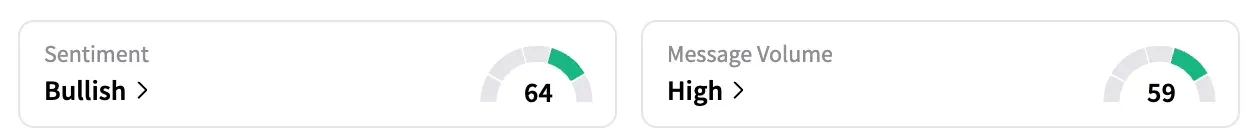

On Stocktwits, the retail sentiment for DASH was 'bullish' as of the last reading, with users noting that the stock is at a breakout level. A new delivery robot and stake sale by a top executive were also driving retail interest in the stock.

On Tuesday, DoorDosh unveiled Dot, its first commercial autonomous robot built to travel on bike lanes, roads, sidewalks, and driveways, and specifically designed for local delivery. The robot will be initially deployed in Tempe and Mesa, Arizona.

Meanwhile, the company disclosed in an exchange filing on Wednesday that President and COO Prabir Adarkar sold $8.1 million worth of company stock.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Netflix Retail Trader Mood Dim Over 'Cancel' Subscription Campaign: Analysts Believe Not Many Would

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2166957713_jpg_a9ada70a7b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227231024_jpg_227a7ced1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Bury_resized_jpg_14e6fc7c2b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ionq_resized_jpg_35563ea1fb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)