Advertisement|Remove ads.

DraftKings Stock Dips On Maryland Tax Proposal: Retail Mood Sours

Shares of DraftKings ($DKNG) slipped 3% on Wednesday after Maryland proposed tax hikes on sports betting and gambling sales as part of its budget plan, dampening retail sentiment.

The proposal reportedly includes a plan to raise the sports betting tax rate to 30% from 15%, and hike the land-based table game tax rate to 25% from 20%. The hikes are part of a “broader tax reform.”

Truist analyst Barry Jonas thinks the proposed hikes are a negative for gaming stocks, but for online sports betting, the hike to a 30% tax rate "could have been much worse,” Fly.com reported citing the analyst.

Maryland would become the third state to hike taxes in online betting should the proposal go into effect. The land-based proposal was the first the analyst firm had seen, added the report.

Other online operators that could be impacted include Flutter Entertainment (FLUT), MGM Resorts (MGM), Caesars (CZR) and Penn Entertainment (PENN) as well as the potential impact to land-based operators such as MGM, and Churchill Downs (CHDN).

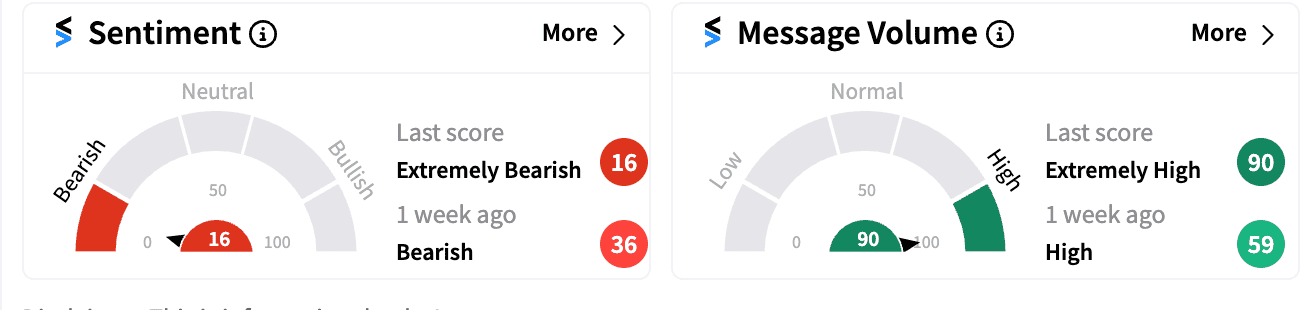

On Stocktwits, retail sentiment on the stock was ‘extremely bearish’ compared to ‘bearish’ a week ago. Message volumes climbed to ‘extremely high’ zone.

Recently, Bloomberg reported the company could be slapped with a federal lawsuit over user video viewing and video game-playing history it shared on third-party platforms, including Meta Inc. The alleged privacy breach would violate the Video Privacy Protection Act.

DraftKings stock is up 4.09% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)