Advertisement|Remove ads.

DraftKings Stock Rises Ahead of Q4 Earnings Amid Friendlier Sports Betting Environment: Retail’s Upbeat

Shares of DraftKings ($DKNG) have risen more than 6% in the past five days ahead of the sports entertainment and gaming company’s fourth-quarter results, with retail sentiment staying bullish.

Wall Street analysts expect the company to post earnings per share of $0.16 on estimated revenues of $1.4 billion, according to Stocktwits data. DraftKings missed EPS and revenue estimates thrice out of the last four quarters.

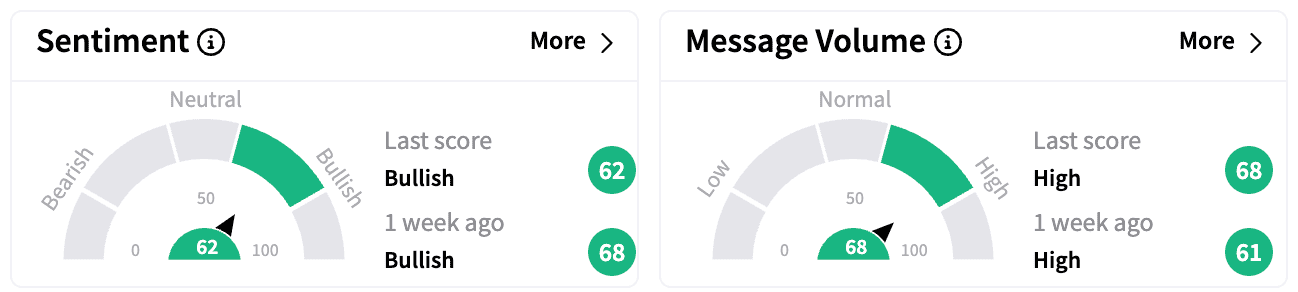

Sentiment on Stocktwits remained ‘bullish’ compared with a week ago. Message volume remained in the ‘high’ zone.

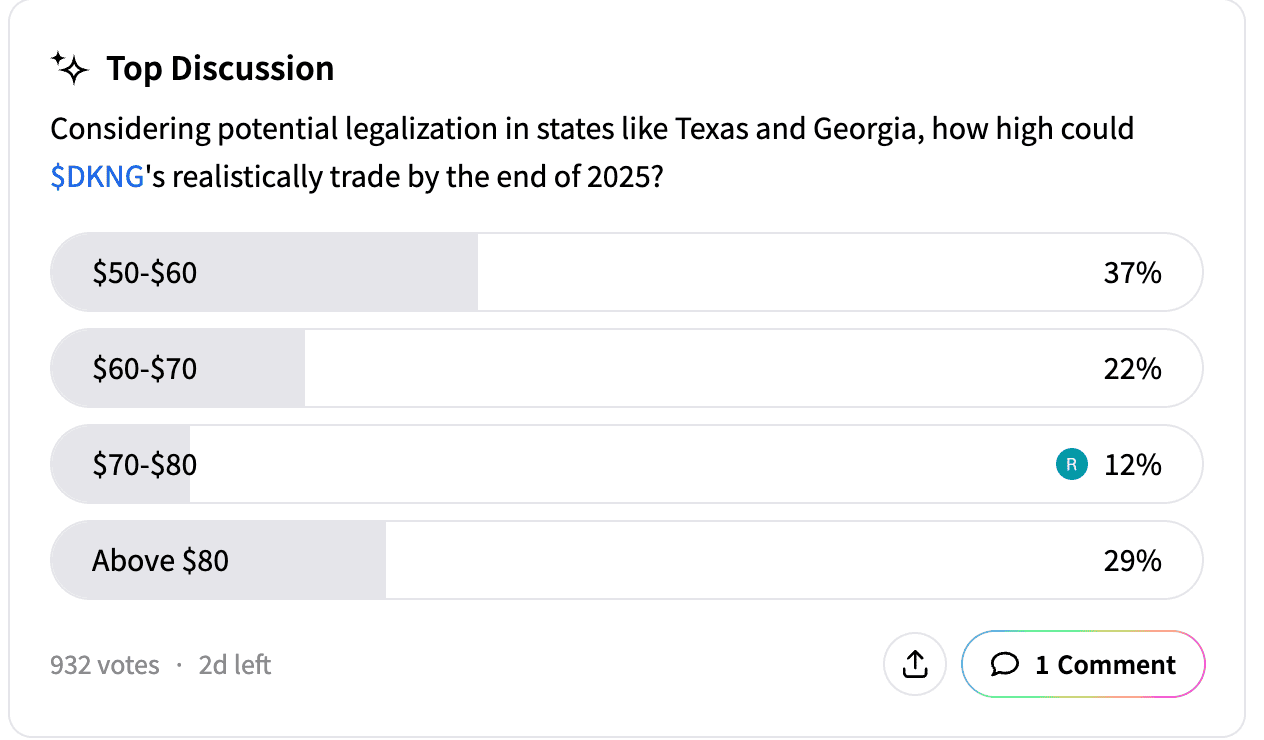

A poll asked users on the Stocktwits platform about their prediction of the company stock price if sports betting gets legalized in some additional states. About 37% of the users thought DraftKings could trade between $50 and $60 by the end of 2025. About one-third thought the stock could trade above $80.

Last week, BMO Capital lowered the price target on DraftKings to $52 from $53 with an ‘Outperform’ rating, Fly.com reported.

According to the analyst, the company's Q4 results are a "bad beat" but ongoing online sports betting legalization efforts could boost DraftKings, added the report. The analyst noted expectations of 35% growth, 15% adjusted EBITDA margins, and meaningful free cash flow ramp.

DraftKings Inc. is a digital sports entertainment and gaming company created to be the Ultimate Host and fuel the competitive spirit of sports fans with products that range across daily fantasy, regulated gaming, and digital media.

DraftKings stock is up 15.6% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)