Advertisement|Remove ads.

Dynatrace Stock Rises On Upbeat Q4 Earnings, Retail Turns Extremely Bullish

Dynatrace Inc (DT) shares traded 2.7% higher in Wednesday’s premarket after the company reported better-than-expected fourth-quarter (Q4) earnings.

The technology provider reported a 17% year-on-year (YoY) increase in its revenue to $445 million, beating the analyst consensus estimate of $435.14 million.

Adjusted earnings per share (EPS) of $0.33 also beat the consensus estimate of $0.30.

Total annual recurring revenue (ARR) improved by 15% to $1.734 billion and subscription revenue grew 18% YoY to $424 million.

The gross profit margin compressed 30 basis points to 80.9%. Operating income jumped 85.5% to $42.9 million, with the operating margin expanding 400 basis points to 10%.

During the fourth quarter, the company spent $43 million to repurchase 787,000 shares at $53.99 a piece.

As of March 31, Dynatrace held $1.01 billion in cash and equivalents. The quarter's operating cash flow was $459.4 million, with a free cash flow of $430.6 million.

"Dynatrace delivered a strong finish to fiscal 2025. Our fourth quarter results exceeded guidance on all of our key operating metrics, fueled by broad consumption growth across the platform," said CEO Rick McConnell.

For the first quarter of FY25, the company expects revenue to be $465 million to $470 million and adjusted EPS in the range of $0.37 to $0.38.

For FY26, Dynatrace expects revenue of $1.895 billion to $1.965 billion with the adjusted EPS of $1.56 to $1.59.

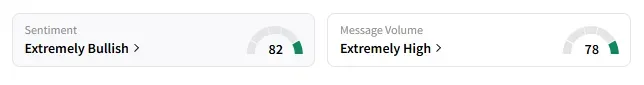

On Stocktwits, retail sentiment jumped to 'extremely bullish' from ‘neutral’ the previous day.

A Stocktwits user picked DT as one of the important stocks to watch for the day.

Dynatrace stock is down 7.01% in 2025 and has gained 8.8% in the last 12 months.

Also See: Super Micro Stock Poised To Build On Gains Amid Ongoing AI Momentum: Retail’s Uber-Bullish

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2166123192_jpg_1bb818cd90.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Civic_resized_jpg_120d89cac4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Opendoor_Technologies_jpg_177252e1f8.webp)