Advertisement|Remove ads.

e.l.f Beauty Stock Drops To Year-Low Ahead Of Q3 Earnings, But Retail’s Optimistic

Shares of e.l.f. Beauty Inc. (ELF) fell more than 1% on Wednesday to a one year-low ahead of the company’s third-quarter earnings, but retail sentiment remained optimistic about the company’s prospects.

e.l.f. Beauty is expected to release its third-quarter earnings after the bell on Thursday. The company has beaten earnings per share and revenue estimates in all four of the past four quarters.

Wall Street analysts expect e.l.f. Beauty to post $0.94 in earnings per share on revenue of $352.70 million, according to Finchat.

For the second quarter, e.l.f. Beauty earnings per share stood at $0.77, beating estimates of $0.43. Revenues came in at $301.08 million, above the consensus estimate of $289.43 million, according to Stocktwits data.

Piper Sandler lowered the price target on Elf Beauty to $131 from $167 with an ‘Overweight’ rating, Fly.com reported. According to the firm, Elf's recent share price weakness "has been meaningfully overdone" and suggested investors to building positions ahead of earnings, added the report.

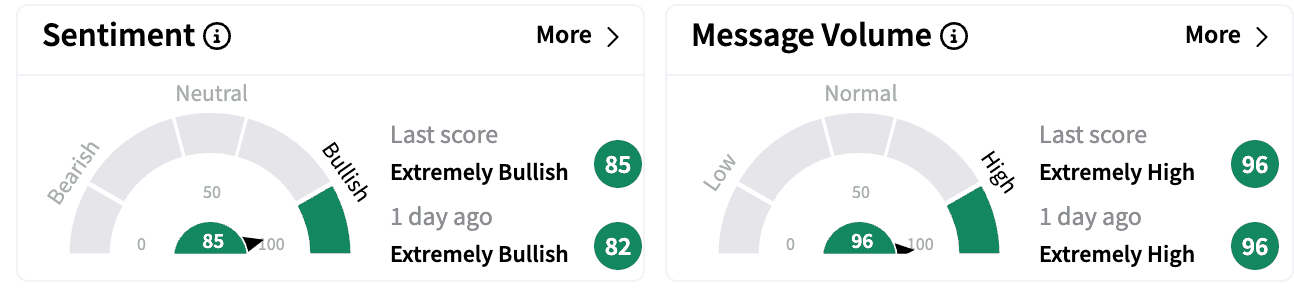

Sentiment on Stocktwits moved up higher in the ‘extremely bullish’ zone from a day ago. Message volumes were also in the ‘extremely high’ zone.

Ahead of its earnings, Stifel also lifted its FY25 and FY26 sales and adjusted earnings before interest, taxes, depreciation and amortization, or Ebitda estimates, noting a "modest upside" to fiscal Q3 consensus sales estimates, Fly.com reported.

E.l.f. Beauty sells cosmetics and skin care products under the brands e.l.f. Cosmetics, e.l.f. SKIN, Keys Soulcare, Well People and NATURIUM.

e.l.f. Beauty stock is down 30% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2071907975_jpg_85e059f13e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219301415_jpg_7634ca599c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2236469013_jpg_0a72164947.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)