Advertisement|Remove ads.

Emergent Biosolutions Stock Soars After Q3 Earnings: Retail Sentiment Strong

Shares of Emergent Biosolutions ($EBS) soared 23% (3 pm ET) Thursday after the company reported strong third-quarter results, lifting retail sentiment.

Earnings per share for Q3 came in at $1.37, compared to consensus estimates of $0.10, a whopping 1225.81% difference. Revenues stood at $293.8 million, up from $270.5 million last year, driven by operational improvements. Wall Street had estimated revenues at $290.33 million. In addition, it has raised its FY24 revenue outlook to $1.05B-$1.13B.

"Through disciplined execution and steady, measurable progress, Emergent's financial position is the strongest it has been since 2021 as evidenced by our favorable third-quarter results," Emergent chief executive, Joe Papa, said in a statement, "We have successfully improved efficiencies and refocused our operations related to customer demand, generated value in our core medical countermeasures and NARCAN Nasal Spray businesses and refinanced our debt leading to increased revenue and cash flow.”

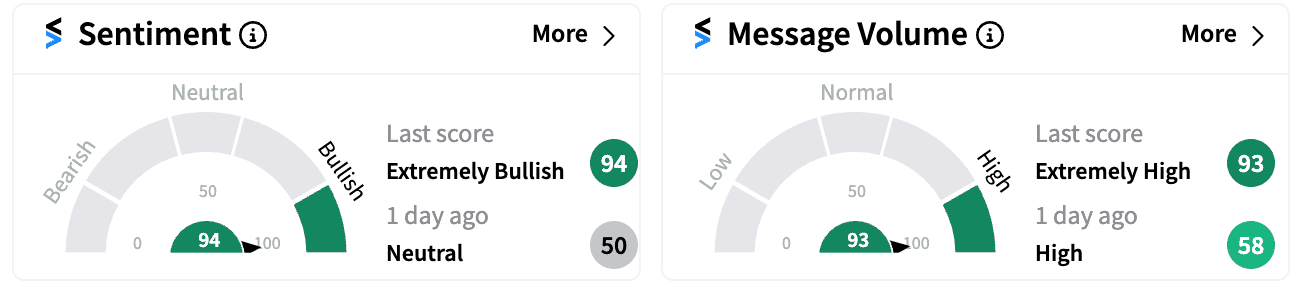

Retail sentiment for the stock turned ‘extremely bullish’ from ‘neutral’ a day ago. Meanwhile, message volumes were at ‘extremely high’ levels.

Emergent is hoping to capitalize on the ongoing public health crises like the opioid overdose epidemic and the Mpox outbreak. On Thursday, it also named Simon Lowry, M.D., as chief medical officer and head of research and development. Lowry, who was previously CEO at Mysthera Therapeutics, will be responsible for advancing Emergent's strategic scientific roadmap, and will oversee research and development, regulatory affairs, medical affairs, clinical and biostatistics, and patient safety.

One Stocktwits user suggested the stock could more than double in value over time, with the recent developments.

Emergent’s stock is up 343.6% year-to-date.

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/04/rich-money-2025-04-f0b4073db42c6bc97979f963f46d5013.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/03/filter-coffee.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/08/sbi-2024-08-3d512e93ea6e88c29c9d7f4713260a92.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/metal-and-mining-2025-10-7f1cf8d6ed7a5d31e2971be9b93f8539.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/2025-10-24t181332z-2012779548-rc2hihawafmm-rtrmadp-3-grindr-m-a-2025-10-eb89b2d5d1b2c7ee27da768ccd3a2e66.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/jane-2-2025-10-0cb531b3a4a4595817838ded781057b1.jpg)