Advertisement|Remove ads.

Economist Steve Hanke Warns Faith In Dollar Is Eroding, Blames It On Trump’s Weaponization Of The Greenback

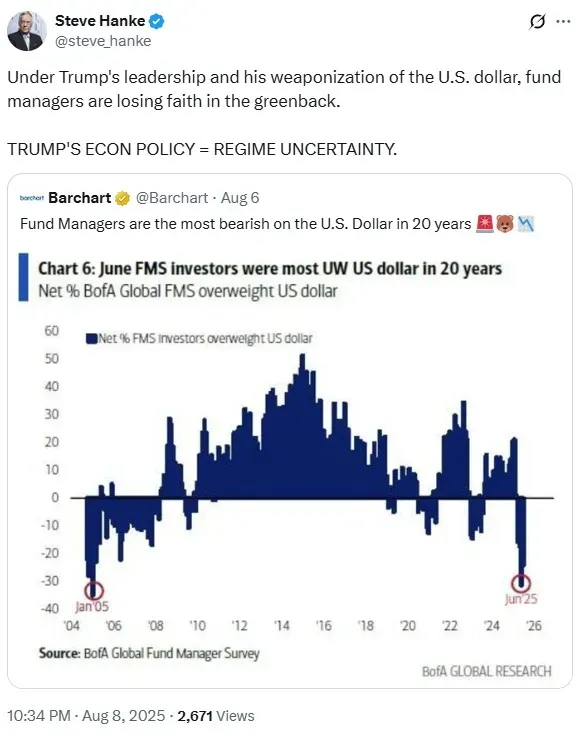

Economist Steve Hanke on Friday warned that faith in the U.S. dollar is eroding because of President Donald Trump’s economic policies and weaponization of the greenback.

Hanke issued the warning in a post on X, citing the findings of Bank of America’s Global Fund Manager survey, which showed that fund managers are the most bearish on the U.S. dollar in 20 years.

“TRUMP'S ECON POLICY = REGIME UNCERTAINTY,” Hanke warned in his post.

Hanke’s caution comes at a time when the dollar has been on a downward trajectory in 2025. The U.S. Dollar Index, which measures the greenback against a basket of currencies of the United States’ major trading partners, is down 10% year-to-date.

Analysts at Morgan Stanley observed that this is the biggest decline in the U.S. dollar in the last 50 years, bringing an end to its 15-year bull cycle. They expect the greenback to decline another 10% by the end of 2026.

“The second act for the dollar’s weakening should come over the next 12 months, as U.S. interest rates and growth converge with those of the rest of the world,” said David Adams, head of G10 FX Strategy at Morgan Stanley.

Analysts at JPMorgan said the dollar has now demonstrated its safe-haven status in 2025, with the greenback declining on the same days as U.S. stocks have closed in the red. This brings the “confidence premium” of U.S. assets into question, the firm noted, adding that President Trump’s tariff threats and his public challenges to the Federal Reserve and its chair, Jerome Powell, are leading to trust concerns.

The WisdomTree Bloomberg U.S. Dollar Bullish Fund (USDU) has declined over 5% year-to-date (YTD). The Invesco DB US Dollar Index Bullish Fund (UUP) has declined 7% YTD, while the Invesco DB US Dollar Index Bearish Fund (UDN) has surged nearly 12%.

Stocktwits data showed the investor sentiment around the three ETFs was in the ‘neutral’ territory.

Also See: Trade Desk, SoundHound, Firefly, BitMine, Freddie Mac: Stocks Making The Biggest Moves Today

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_original_jpg_285085becb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262712431_1_jpg_6f471d2542.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259503553_jpg_13fb8f2e88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)