Advertisement|Remove ads.

Editas Medicine Stock Slides After-Hours On Bigger-Than-Expected Q4 Loss, But Retail Bulls Eye M&A Potential

Shares of Editas Medicine Inc. (EDIT) fell more than 6% in after-hours trading on Wednesday after posting a wider-than-expected fourth-quarter loss.

Retail traders remained optimistic despite the decline, with some speculating on potential mergers and acquisitions, particularly after the company opted not to hold an earnings conference call.

The genome-editing company reported an adjusted loss of $0.55 per share for the quarter, exceeding the $0.38 loss projected by analysts. However, revenue reached $30.6 million, slightly above Wall Street's estimate of $29.76 million.

The company's net loss for the three months ended Dec. 31, 2024, was $45.4 million, compared to $18.9 million a year earlier.

Revenue from collaboration and research and development activities dropped significantly to $30.6 million from $60 million in the year-ago period.

The decline was primarily due to the absence of revenue recognized in 2023 from the upfront payment under Editas' license agreement with Vertex Pharmaceuticals.

Additionally, the company recorded $12.2 million in restructuring charges related to its decision to discontinue clinical development of the reni-cel program, which was announced in December 2024 and led to workforce reductions.

Editas ended the quarter with $269.9 million in cash, cash equivalents, and marketable securities, a slight increase from $265.1 million at the end of September 2024.

The company expects its current cash position and retained portions of payments from its agreement with Vertex to support operations into the second quarter of 2027.

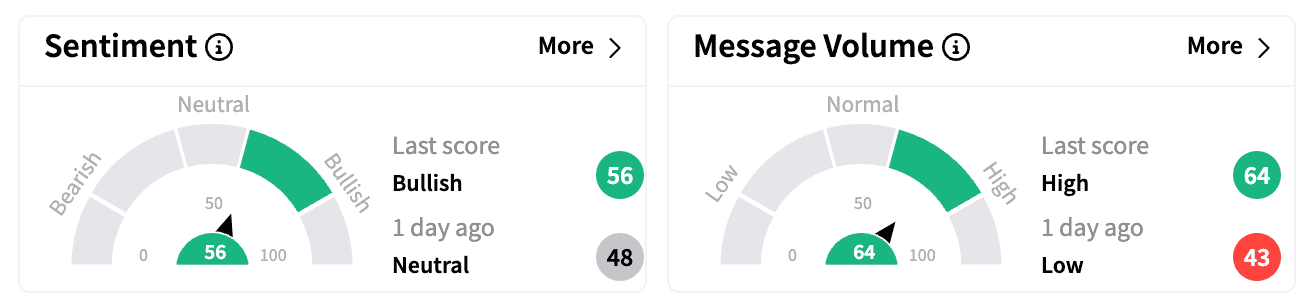

On Stocktwits, sentiment for Editas turned 'bullish' from 'neutral' within 24 hours to Wednesday's close, with message volume surging 438%.

Some retail traders viewed the company's financial position as a sign of resilience, with some pointing to its ability to operate without needing additional financing.

Others speculated that the lack of an earnings call could signal a significant corporate development on the horizon.

One user suggested that the absence of a call might indicate an impending M&A announcement.

Another noted that the stock's earnings miss was offset by its revenue beat, adding that "something is definitely in the works."

Editas Medicine said it would participate in the Leerink Partners Global Biopharma Conference on March 10 and the Barclays 27th Annual Global Healthcare Conference on March 11, both in Miami Beach, Florida.

The stock remains up more than 61% year-to-date but has plunged nearly 80% over the past 12 months.

According to Koyfin data, short interest in the stock last stood at 21.1%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1248428688_jpg_059f14eab1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Palo_Alto_logo_1200pi_resized_jpg_eee56769fa.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_crash_490d43331a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_88435a6487.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)