Advertisement|Remove ads.

EIL Rises On ₹618 Crore Overseas Contract; Technicals Hint At Breakout Above ₹215, Says SEBI Analyst

Engineers India (EIL) shares rallied 4% intra-day on Monday on securing a ₹618 crore African contract.

The company won an international contract from an African fertilizer company. The deal covers Project Management Consultancy (PMC) as well as Engineering, Procurement and Construction Management (EPCM) services for a new fertilizer plant. The project is expected to be executed over 24 months and covers end-to-end consultancy and engineering support for setting up the facility.

EIL clarified that the contract does not involve any promoter or related party and is a purely commercial win.

Over the past year, EIL stock has traded between ₹142 and ₹255, and the current level remains below its 52-week high, leaving room for potential upside if sentiment improves, according to SEBI-registered analyst A&Y Market Research. They, however, cautioned that EIL’s latest quarterly results showed some pressure.

In Q1 FY26, net profit fell by about 28–29% year-on-year, even as revenues grew strongly. Higher costs and margin pressures weighed on the bottom line.

What Does The Order Bring For EIL?

A&Y Market Research added that this order significantly strengthens EIL’s order book and enhances its international credentials, demonstrating its ability to deliver large consultancy and project management assignments outside India. The ₹618-crore deal will support revenue visibility over the next couple of years without exposing the company to the high capital risks of complete EPC contracts.

However, they believe that executing projects in overseas markets presents challenges such as project delays, cost overruns, currency fluctuations, and political risk. Moreover, revenue recognition will be phased over the 24 months, meaning the near-term financial boost may be modest.

What Should Traders Do?

On the technicals, they added that the stock was forming a higher low pattern after the August bottom.

A breakout above ₹213–₹215 could open the path to ₹228–₹230, and sustaining above these levels would confirm a reversal toward ₹245 and higher (the next target zone). On the downside, ₹202–₹205 was seen as a crucial support. And a break below this could lead to retesting the ₹190 levels.

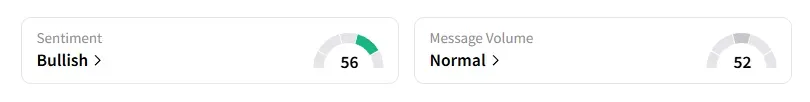

What Is The Retail Mood?

Data on Stocktwits shows that retail sentiment has been ‘bullish’ for a week on this counter.

EIL shares have risen 15% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_changpeng_zhao_binance_CEO_OG_jpg_1f2a158765.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263411662_jpg_efc7c78da8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2213700945_jpg_100e788722.webp)