Advertisement|Remove ads.

Endeavour Silver Stock Rips On Q4 Earnings Beat: Retail Sentiment Soars On Miner’s Optimistic Outlook

Shares of Endeavour Silver Corp. (EXP) ripped in Tuesday’s regular trade, gaining more than 24% as the company’s fourth-quarter earnings surpassed Wall Street expectations, resulting in retail sentiment turning positive.

Endeavour reported earnings per share (EPS) of $0.02 during Q4, compared to an expected loss of $0.01 per share during the quarter. Its EPS is unchanged on a year-on-year basis.

The mining company’s topline witnessed a slight decline – at $42.2 million in revenue during Q4 – lower than the expected $47.71 million. During the same period a year earlier, Endeavour posted revenue of $63.7 million.

While the revenue miss overshadowed the earnings beat to a certain extent, Endeavour remains optimistic about its growth outlook.

The Canada-based mining company provided an update on the Terronera project’s status, saying it is 89.4% complete, with the construction expected to wrap up by Q2 2025. Commercial production is expected to commence in Q3.

“With the Terronera project nearing completion and Pitarrilla progressing toward an economic assessment, we are well-positioned for sustained growth and value creation,” said Endeavour’s CEO Dan Dickson.

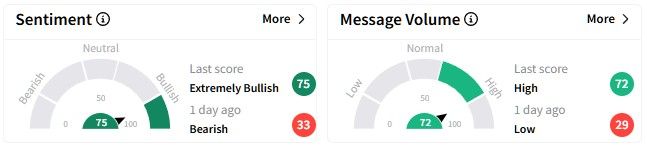

Reacting to the results, retail sentiment on Stocktwits soared, entering the ‘extremely bullish’ (75/100) territory from ‘bearish’ (36/100) a day ago.

Message volumes surged to ‘high’ levels.

One user thinks that Endeavor stock should have “solid support under current conditions.”

FinChat data shows that of the seven brokerage calls, there are four ‘Buy,’ two ‘Outperform,’ and one ‘Hold’ rating.

Endeavour’s stock has gained nearly 24% year-to-date, while more than doubling over the past year, with gains of over 111%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Ciena Stock Gains Aftermarket On Q1 Results Beat, But Retail’s Still Bearish

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Solana_722b6a3879.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_X_Elon_Musk_274c6a8683.webp)