Advertisement|Remove ads.

Ex-Tesla Board Member Warns EV Maker Must ‘Bend Over Backwards’ To Defend Share Price In 2026

- Westly said 2026 will be a challenging year as Tesla faces weaker vehicle sales and profit pressure.

- He said robotaxis are key to the story but Tesla still trails Waymo on scale and approvals.

- He highlighted Tesla’s energy business as a potential source of growth.

Steve Westly, a former board member at Tesla, said the company will need to work aggressively to keep its share price elevated as it heads into what he described as a pivotal period for the business.

Westly said 2026 will be a critical year for Tesla, noting that the company is likely to post a second consecutive year of declining vehicle sales and shrinking profits. With Tesla’s market value hovering near record highs, he said the company will need to deliver tangible progress to support investor expectations, according to an interview on CNBC's Squawk on the Street.

“They’re going to have to bend over backwards to keep that share price up,” Westly said.

The stock fell 1.3% to $479.26 at the time of writing.

Robotaxis Become Central To Tesla’s Valuation

Westly’s comments come as robotaxis play an increasingly important role in Tesla’s investment case. Morgan Stanley says about 30% of Tesla’s sum-of-the-parts value comes from robotaxis.

Tesla recently updated a page on its website related to its robotaxi service, indicating that the autonomous service is now available in Austin, Texas, on the Model Y, and that it has expansion plans for the future, including the launch of the no-pedal, no steering wheel Cybercab.

Westly Says Tesla Trails Waymo On Key Metrics

Westly said Tesla still has significant ground to make up relative to Waymo, particularly in scale, regulatory approvals, and real-world performance.

He said Tesla’s robotaxis currently travel about 1,500 miles between critical interventions, compared with roughly 17,000 miles for Waymo. Westly added that Waymo operates in about 20 markets and expects to complete around 14 million rides this year, rising to roughly 35 million next year.

He added, by contrast, that Tesla’s robotaxi service is only available in two cities and still needs safety drivers.

Westly said Tesla needs regulatory approval for robotaxis in more cities and growth in new areas, including its energy business, adding that companies like Tesla are no longer just car companies but also technology and energy companies.

Energy And New Businesses Seen As Key To Growth

Westly said investors will be looking beyond vehicles and robotaxis alone, pointing to Tesla’s energy division as a potential growth driver. He said the company is benefiting from rising power demand linked to AI and data centers, which is forcing utilities to seek new energy solutions.

He said Tesla’s energy business, which includes Powerwall and Megapack products, could grow from about $10 billion last year to roughly $14 billion this year, representing about 40% growth.

How Did Stocktwits Users React?

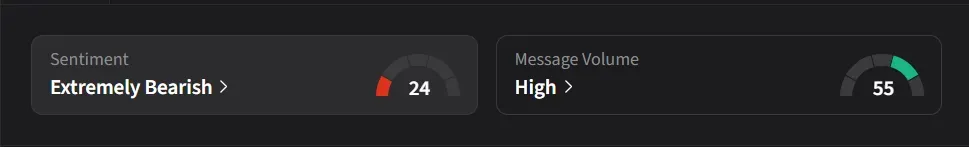

On Stocktwits, retail sentiment for Tesla was ‘extremely bearish’ amid ‘high’ message volume.

One user said they believe 2026 could be Tesla’s worst year, arguing that Elon Musk is aware of the challenges and pointing to his move to take SpaceX public as evidence.

Another bullish user expects “bounce to $482 from here!!!”

Tesla’s stock has risen 18% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2189643067_jpg_243b1172b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1494564204_jpg_be6f667516.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)