Advertisement|Remove ads.

Expect double-digit corporate loan growth; confident of meeting FY25 guidance: PNB's Ashok Chandra

On the consolidation of public sector undertaking (PSU) banks, Punjab National Bank Managing Director and CEO Ashok Chandra said, “Let us wait and see how the government and the regulators propose it.”

Punjab National Bank (PNB) Managing Director and CEO Ashok Chandra said the lender is confident of achieving its full-year credit and deposit growth targets.

“We are very hopeful… by the end of the financial year, we should be in a position to touch double-digit growth in the corporate loan book,” Chandra said.

Chandra said PNB will stay on course to meet its credit growth guidance of 11-12% and deposit growth target of 9-10% for the year. “For the full year, we will be sticking to the guidance and there will be some good momentum,” he said. Deposits have already grown over 10.5% year-on-year (YoY), he added.

Commenting on the goods and services tax (GST) rate cuts, Chandra said the move is likely to boost credit demand in key segments. “The simplification and rate cut in GST will bring momentum in the credit portfolio, especially in retail, agri, and MSME,” he said, adding that the impact “is not short-term” and will enhance purchasing power and long-term credit growth.

Also Read | PNB sees big uptick in vehicle, housing loans; Shriram Finance stays cautious

On project and infrastructure funding, Chandra said the Reserve Bank of India’s (RBI) recent measures have helped banks support new investments. “We had a pool of ₹1.38 lakh crore in the sanctioned corporate book, and this has gone up further in the April-June quarter and the July-September quarter,” he said. He urged corporates to avail these facilities, noting that disbursements take time as projects unfold over one to two years.

Chandra also said PNB Housing Finance’s board and nomination committee are finalising the selection of a new candidate, with an announcement expected by the end of the month.

Also Read | PNB's global business up 11% to ₹27.87 lakh crore in September 2025

Chandra confirmed that PNB plans to dilute 10% of its 23% stake in Canara HSBC Life, estimating proceeds of about ₹900 crore from the sale.

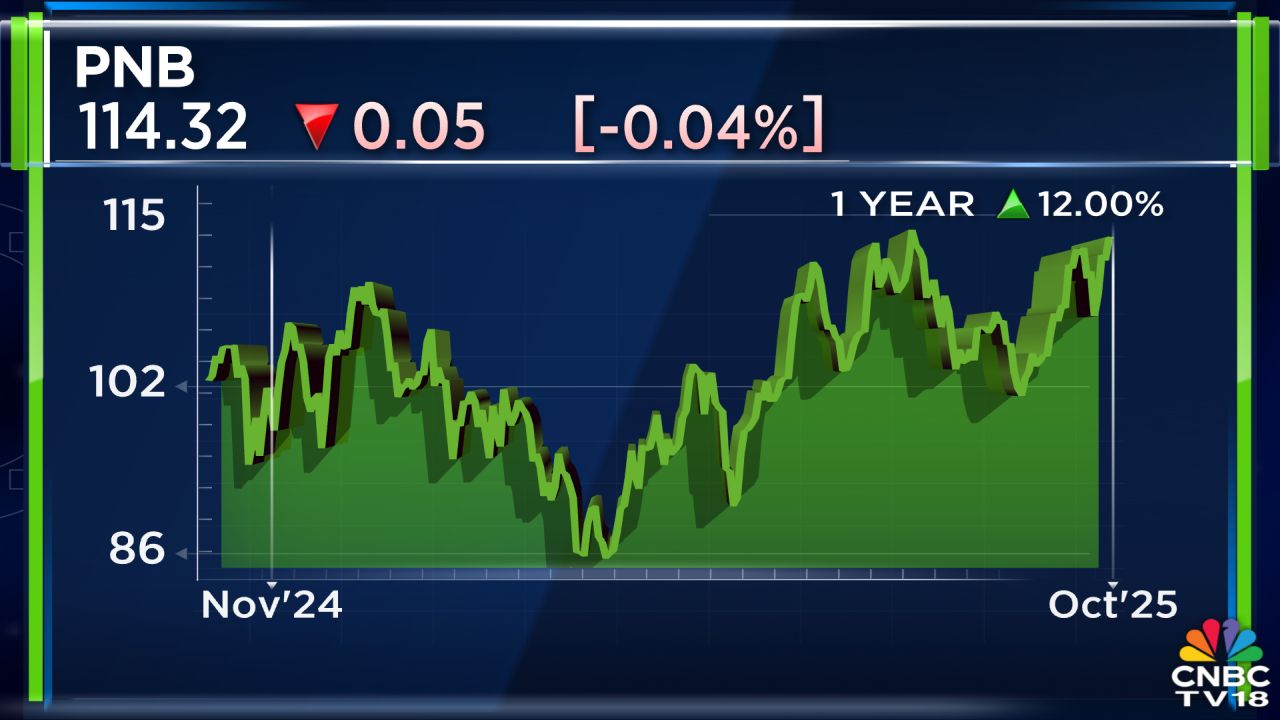

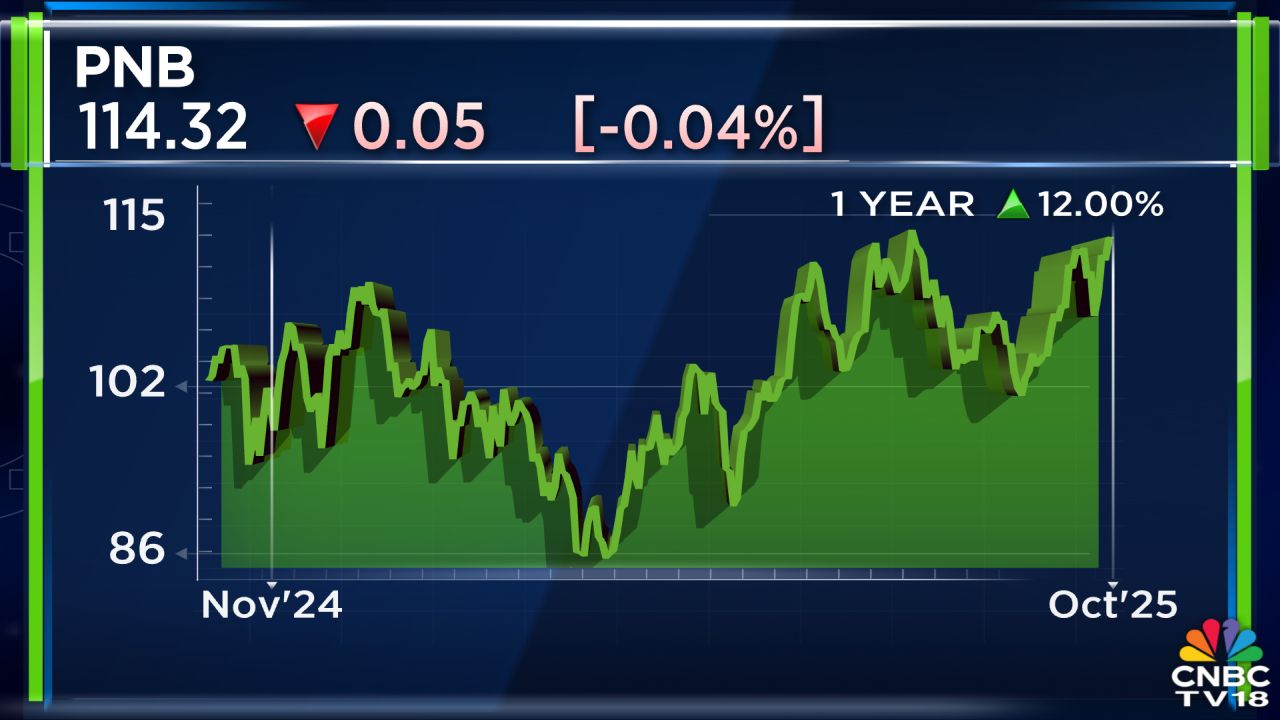

PNB’s market capitalisation stands at ₹1.31 lakh crore, with its shares rising 12% over the past year.

For the full interview, watch the accompanying video

Catch all the latest updates from the stock market here

“We are very hopeful… by the end of the financial year, we should be in a position to touch double-digit growth in the corporate loan book,” Chandra said.

Chandra said PNB will stay on course to meet its credit growth guidance of 11-12% and deposit growth target of 9-10% for the year. “For the full year, we will be sticking to the guidance and there will be some good momentum,” he said. Deposits have already grown over 10.5% year-on-year (YoY), he added.

Commenting on the goods and services tax (GST) rate cuts, Chandra said the move is likely to boost credit demand in key segments. “The simplification and rate cut in GST will bring momentum in the credit portfolio, especially in retail, agri, and MSME,” he said, adding that the impact “is not short-term” and will enhance purchasing power and long-term credit growth.

Also Read | PNB sees big uptick in vehicle, housing loans; Shriram Finance stays cautious

On project and infrastructure funding, Chandra said the Reserve Bank of India’s (RBI) recent measures have helped banks support new investments. “We had a pool of ₹1.38 lakh crore in the sanctioned corporate book, and this has gone up further in the April-June quarter and the July-September quarter,” he said. He urged corporates to avail these facilities, noting that disbursements take time as projects unfold over one to two years.

Chandra also said PNB Housing Finance’s board and nomination committee are finalising the selection of a new candidate, with an announcement expected by the end of the month.

Also Read | PNB's global business up 11% to ₹27.87 lakh crore in September 2025

Chandra confirmed that PNB plans to dilute 10% of its 23% stake in Canara HSBC Life, estimating proceeds of about ₹900 crore from the sale.

PNB’s market capitalisation stands at ₹1.31 lakh crore, with its shares rising 12% over the past year.

For the full interview, watch the accompanying video

Catch all the latest updates from the stock market here

Read about our editorial guidelines and ethics policy

/filters:format(webp)https://news.stocktwits-cdn.com/large_warner_bros_discovery_wbd_resized_jpg_bae2c7edb6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Federal_Reserve_jpg_04f5bfad5f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_stock_jpg_1a4860daf4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_AI_jpg_dc0a17a95b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/07/cotton-exports-2025-07-c0b0c3f267a621e19918ffffcfc1d360.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_AMD_jpg_7da03a7d41.webp)