Advertisement|Remove ads.

Finolex Cables Down 30% In 2025, But SEBI Analyst Sees A Strong Buying Opportunity

India’s leading manufacturer of cables, Finolex Cables, has had a weak run this year, with its shares declining near 30% in 2025. But analysts believe that it now offers a compelling opportunity for traders as the decline is due to a healthy market correction and not a sign of fundamental weakness.

As of late September, the stock has experienced a significant retracement from its 52-week high of around ₹1,559 to its current levels near ₹827. SEBI-registered analyst Yashdeep Kothari noted that Finolex Cables is hovering near a crucial support level and that this consolidation is a necessary precursor to a new leg up.

Technical Outlook

He added that the stock's 52-week low at ₹780 is a critical demand zone where previous supply has been absorbed, making it an attractive point for dollar-cost averaging. Any move toward this level would present a high-conviction buying opportunity.

Additionally, a bullish divergence is forming on key momentum indicators such as the RSI and MACD. As the price has declined, the strength of the bearish move has waned, suggesting that selling pressure is exhausted and a reversal is imminent.

And the price action has been carving out a falling wedge pattern, a classic bullish chart formation – indicating that the stock is coiling for a high-volume breakout to the upside.

Fundamental Analysis

Kothari believes that beneath the short-term price volatility, Finolex Cables' fundamentals remain exceptionally strong. The stock is undervalued with its price-to-earnings (P/E) ratio of approximately 20.43, which is significantly lower than the industry's P/E of around 46.94.

The company’s near-zero debt status, robust balance sheet and strategic growth plans are the other drivers behind this bullish outlook.

Trading Strategy

According to Kothari, Finolex Cables presents a compelling long-term buying opportunity. He advised investors to consider a staggered buying strategy, with a significant tranche around the ₹780 support level.

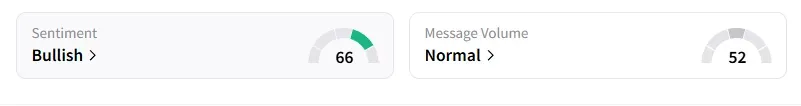

What Is The Retail Mood?

Data on Stocktwits shows that retail sentiment has been ‘bullish’ for a week on this counter.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_robotaxi_jpg_ade25faaed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)