Advertisement|Remove ads.

Target Tests Overnight, Next-Day Delivery In Major Markets As It Races To Cut Costs And Speed Shipping

- Target is shifting fulfillment loads in Chicago, opening a new sortation center in Cleveland and using gig workers in San Diego.

- The company is responding to weak sales and rising expectations for faster, cheaper delivery.

- Market-specific changes aim to ease store strain and speed up order processing.

Target is reportedly testing overnight and next-day fulfillment options in multiple U.S. cities as the retailer seeks to cut shipping costs, speed deliveries and ease store crowding after years of lagging sales.

The company has ended ship-to-home order fulfillment from some of its busiest stores in Chicago, launched a new overnight-delivery center in Cleveland and is experimenting with gig workers on some packages in San Diego and elsewhere, according to a Wall Street Journal report.

Gretchen McCarthy, the company’s chief supply chain and logistics officer, said it aims to offer multiple ways to receive orders, including curbside pickup and next-day brown-box delivery, according to the report.

Holiday Season Adds Pressure

The test comes at a critical time for retailers heading into the most important shopping stretch of the year. Holiday shopping is underway, and retailers ranging from Walmart to Best Buy are saying that shoppers are still spending but are more deal-driven as they face higher prices. Black Friday and Cyber Monday brought strong traffic, and the National Retail Federation projects that holiday sales will climb 3.7% to 4.2% this year to as much as $1.02 trillion.

Sales Slump Drives Need For Operational Changes

Target has struggled over the past three years with complaints about cluttered stores, stockouts and weaker product appeal. Last month, it posted its 12th consecutive quarter of soft or negative comparable sales. Comparable sales were down 2.7% in the three months ended Nov. 1. Digital comparable sales increased 2.4% and now make up 19% of total sales, up from 7.5% in 2019.

Fulfillment From Stores Remains Complicated

Target has been using its network of nearly 2,000 stores, within 10 miles of 75% of the U.S. population, to fill online orders, pointing to a tactic both Amazon and Walmart have also adopted. Fulfilling online orders through stores has become a difficult balancing act. In some cases, items can run out of stock before online orders are finished, aisles can become congested with order pickers, and the backroom runs out of packing space.

Market-Specific Adjustments

To tackle those problems, Target is customizing its strategy by market. In Chicago, for example, moving next-day orders from 18 busy stores to less crowded ones has not only accelerated deliveries by about a day but has also cut shipping costs. Local customers also said their stores were cleaner and had more staff and fewer out-of-stock items.

In Cleveland, a new 40,000-square-foot sortation center operated by Ryder batches store-picked orders by neighborhood for delivery exclusively by Shipt drivers, who can make more frequent pickups than national carriers. In San Diego, where no sortation center exists, stores have begun sorting next-day delivery orders in-house for Shipt drivers to collect and deliver locally.

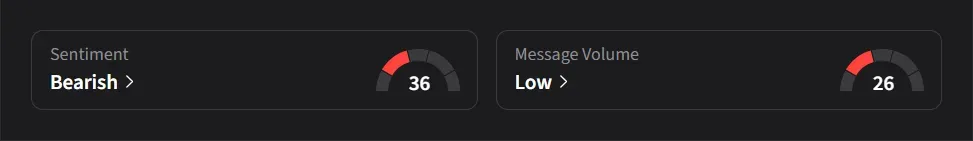

Stocktwits Draws Bearish Mood

On Stocktwits, retail sentiment for Target was ‘bearish’ amid ‘low’ message volume.

Target’s stock had declined 30% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Netflix_jpg_8bc1596785.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239888469_jpg_5e0e3b606c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vir_biotech_jpg_f43ff73654.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2170386387_jpg_600d460275.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228900989_jpg_e94daec744.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)