Advertisement|Remove ads.

First Majestic Silver Stock Jumps On Record Free Cash Flow, Q4 Revenue Beat– But Retail Wants More

First Majestic Silver Corp. (AG) shares climbed nearly 6% in midday trading Thursday after the miner reported record free cash flow in the fourth quarter, which more than doubled sequentially and grew exponentially from the year-ago period.

The silver producer posted earnings per share (EPS) of $0.03, in line with Wall Street expectations, according to Koyfin data.

Revenue came in at $172.3 million, exceeding estimates of $160 million and marking a 25% increase year over year.

The company’s free cash flow reached a record $68.4 million in the final quarter of 2024, more than doubling from $31.3 million in the prior quarter and 18 times higher than $3.8 million recorded a year earlier.

“The improvement in free cash flow was driven by improved silver equivalent (AgEq) production, higher realized silver prices, and lower costs during the quarter,” the company said.

The company also noted that its methods to calculate the measures may differ from those used by other companies with similar descriptions.

Meanwhile, First Majestic’s earnings before interest, taxes, depreciation, and amortization (EBITDA) surged to $62 million, up from $33.4 million in the fourth quarter of 2023.

The company attributed the improvement to higher mine operating earnings and reduced restructuring costs, particularly at its San Dimas operation.

The company highlighted that it achieved annual silver production of 21.7 million AgEq ounces – consisting of 8.4 million silver ounces and 156,542 gold ounces at an all-in sustaining cost (AISC) of $21.11 – while keeping costs in line with its projections.

For the full year, revenue totaled $560.6 million, down 2% from 2023, mainly due to a 20% decline in AgEq ounces sold following the temporary suspension of mining operations at Jerritt Canyon in March 2023.

Despite the dip in revenue, First Majestic ended the year holding $308.3 million in total cash, including $202.2 million in cash and equivalents and $106.1 million in restricted cash. The company also reported $224.5 million in working capital.

As of year-end, First Majestic held 539,153 ounces of silver and 2,595 ounces of gold bullion, with a total fair value of $22.4 million.

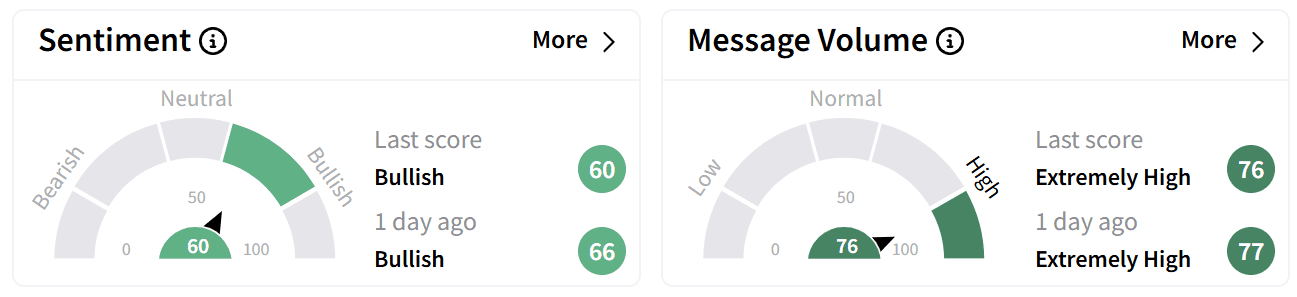

On Stocktwits, retail sentiment around the silver producer remained in the ‘bullish’ (60/100) zone, accompanied by ‘extremely high’ levels of chatter.

While investors were encouraged by the company’s results, some expressed disappointment that the stock did not rally further despite silver prices strengthening amid multiple tailwinds.

Macroeconomic factors, including former President Donald Trump’s tariff policies, which could slow global economic growth, and expectations that the Federal Reserve will maintain a restrictive monetary stance, have supported silver prices.

First Majestic shares are up 22% over the past year but have traded mostly flat in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)