Advertisement|Remove ads.

Flight Simulator Maker CAE's Stock Rallies On Strong Q2 Beat As Pilot Hiring Trends Show Early Recovery Signs

- Its revenue for the quarter ended Sept. 30 stood at C$1.24 billion, above expectations of C$1.13 billion.

- CAE said second-quarter revenue in its civil aviation segment rose to C$670 million, compared with C$640.7 million in the year-ago quarter.

- The firm said that indications from U.S. airlines suggest pilot hiring has resumed.

Flight simulator maker CAE's Stock rose nearly 8% in extended trading on Tuesday after the firm’s fiscal second-quarter earnings topped analysts’ estimates.

On an adjusted basis, the Canadian firm reported earnings of C$0.23 per share, which topped analysts’ estimates of C$0.20 per share, according to Fiscal.ai data. Its revenue for the quarter ended Sept. 30 stood at C$1.24 billion ($882.2 billion), above expectations of C$1.13 billion.

What Drove The Earnings?

CAE said second-quarter revenue in its civil aviation segment rose to C$670 million, compared with C$640.7 million in the year-ago quarter. During the quarter, the unit delivered 12 full-flight simulators (FFSs), and the Civil training centre utilization was 64%. Its defense segment revenue also rose to $566.6 million, compared with C$495.9 million in the year-ago quarter.

“While CAE continues to maintain its leading market share, the first half reflected a decrease in commercial airline pilot hiring activity — down approximately 40% year over year in the U.S., and about 70% below the 2022 peak,” the company said.

Many airlines were forced to cut capacity amid an uncertain demand outlook following U.S. President Donald Trump’s tariff policy, which affected consumer sentiment.

The company said it now expects total annual capital expenditures to be about 10% lower than in fiscal 2025. The decrease is driven primarily by an approximately 25% reduction in Civil capital expenditures, reflecting the slower near-term pace of demand recovery.

Green Shoots For Aviation Ahead

While CAE acknowledged that the civil aviation segment underperformed in the first half of the year, it added that pilot hiring activity has passed the trough and is currently improving, as indications from U.S. airlines suggest pilot hiring has resumed.

“Commercial aviation continues to be most affected by new aircraft availability, aircraft groundings, and pilot hiring. Despite these near-term dynamics, demand is expected to strengthen over the long term as production and delivery rates increase, grounded aircraft return to service, and pilot retirements continue,” the company said.

The push from NATO and allies to boost defense spending to 5% of their gross domestic product will likely lead to higher demand for CAE’s training and simulation solutions, the company added.

What Are Stocktwits Users Thinking?

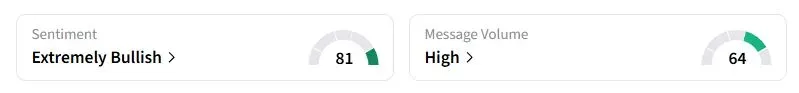

Retail sentiment on Stocktwits about CAE jumped to ‘extremely bullish’ territory from ‘bullish’ a day ago, while retail chatter was ‘high.’

“Looking for a new 52-week high. Great job on earnings,” one user wrote.

CAE stock has gained over 8% this year.

(C$1 = $0.71)

Also See: SpaceX’s Starlink Launches $40 Internet Plan To Take On Fiber Giants AT&T And Verizon

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)