Advertisement|Remove ads.

Ford, GM, Stellantis Stocks Gain As Trump Delays Mexico, Canada Auto Tariffs — But Retail Frustration Mounts Over Policy Whiplash

Shares of Ford Motor Co., General Motors Co., and Stellantis NV rallied on Wednesday after the Trump administration announced a temporary exemption from tariffs on some vehicles imported from Mexico and Canada.

While the move provided relief for automakers, retail investors reacted with growing frustration over the administration’s shifting stance on trade policy.

Stellantis saw its best single-day gain on record, Ford recorded its biggest jump in nearly a year, and GM logged its strongest session in over four months.

The market’s optimism came after White House press secretary Karoline Leavitt confirmed in a briefing that the administration would grant a one-month exemption on automakers operating under the U.S.-Mexico-Canada Agreement (USMCA).

However, she emphasized that reciprocal tariffs would still take effect on Apr. 2.

Leavitt noted that the exemption was intended to prevent economic disadvantages.

Only companies complying with the agreement, which requires a specific percentage of North American-made components, would qualify for tariff-free treatment.

Media reports have noted that executives from GM, Ford, and Stellantis have been lobbying for exemptions over the last few weeks.

On Stocktwits, investor sentiment reflected deeper concerns about trade uncertainty.

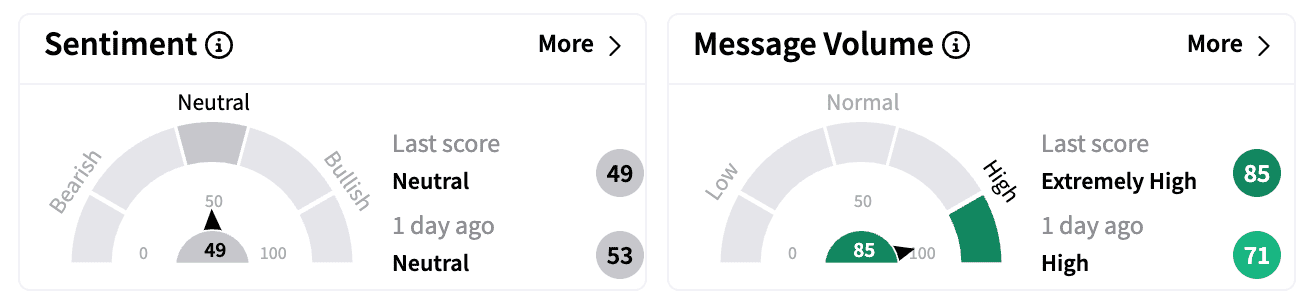

While GM’s sentiment remained ‘neutral,’ some traders cited analyst warnings that tariffs could ultimately drive up costs for automakers reliant on lower-cost Mexican labor, potentially eroding profits and making the stocks less attractive.

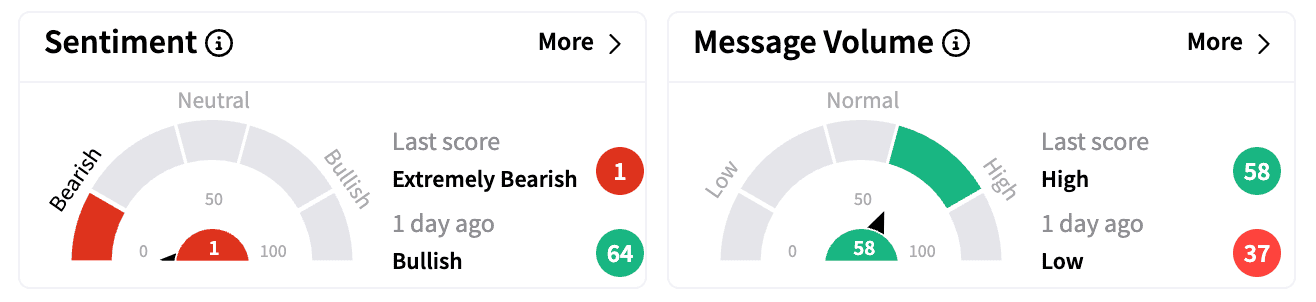

Ford’s sentiment dropped to ‘extremely bearish,’ nearing record lows, as retail traders debated the broader economic impact of tariffs.

One user cautioned that “Trump tariffs could quickly cut North American auto production by a third.”

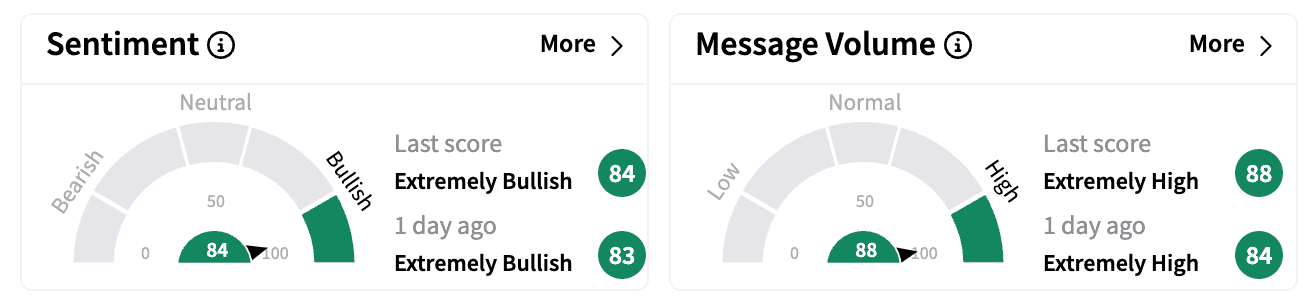

Stellantis, despite its heavy exposure to Mexican manufacturing, saw sentiment surge to ‘extremely bullish.’

Several investors view its recent price levels as an attractive entry point.

Its diversified revenue stream — including a strong presence in Europe with brands like Fiat and Peugeot — is likely helping offset concerns about tariff risks.

Last year, Stellantis generated nearly 59 billion euros ($63.78 billion), or about 37% of its total net revenue, from the European market.

Wednesday’s rally helped trim year-to-date losses for Ford to 2.6%, GM to 9%, and Stellantis to just 0.5%.

However, Ford and Stellantis slipped in after-hours trading, while GM remained flat.

(1 euro = $1.08)

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1005541622_jpg_8079d8d434.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137832_jpg_1de3e68131.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bmnr_OG_jpg_83d4f3cc27.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)