Advertisement|Remove ads.

Ford Shuffles Key Leadership Ahead Of Q4 Results, Anxious Retail Keeps Eye On Trump’s Effect

Ford Motor Co.’s stock saw marginal gains on Wednesday afternoon as investors awaited the company’s fourth-quarter results, scheduled for release after the closing bell.

Ahead of the highly awaited print, the company made several leadership changes earlier in the day.

Effective Thursday, Sherry House will succeed John Lawler as chief financial officer (CFO). House was formerly vice-president of Finance from June 2024.

Lawler will continue with Ford as vice-chair, focusing on strategy and corporate development.

In addition to the CFO change, Ford appointed Marin Gjaja as chief strategy officer. He previously served as chief operating officer for Ford Model e, which focused on the company’s electric vehicle efforts.

Andrew Frick will expand his responsibilities to become president of both Ford Blue and Ford Model e, with a continued focus on electric vehicles.

Kay Hart will transition to general manager of Ford Model e under Frick. Sam Wu, president of Ford China, will now also lead the International Markets Group.

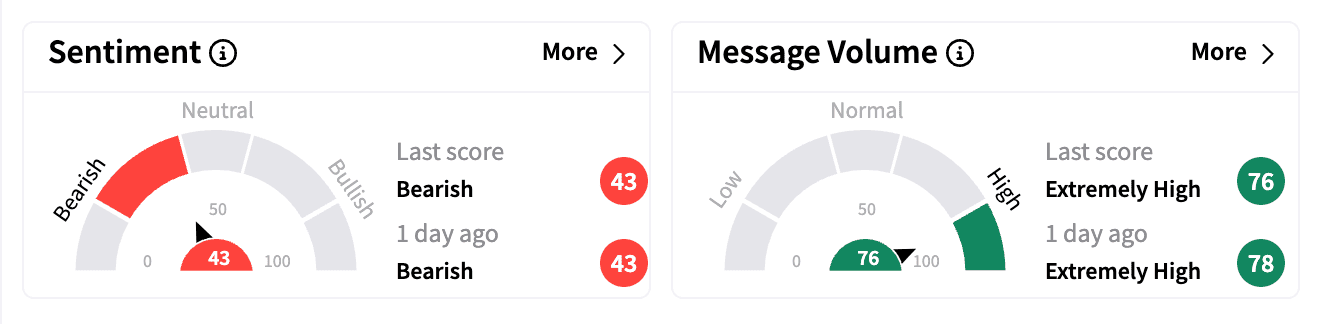

On Stocktwits, Ford sentiment remained ‘bearish’, with extremely high message volume reflecting retail investors’ caution.

Retail traders on Stocktwits anticipate a sharp drop in Ford’s stock following earnings, with some concerned that the company might miss its Q4 targets.

Wall Street analysts predict adjusted earnings per share of $0.33 and revenue of $43.02 billion for Q4.

Ford has struggled recently with unexpected warranty and recall issues, which led to underperformance last year.

Despite an 8.8% year-over-year growth in Q4 U.S. sales, Ford’s stock has fallen more than 7% in the last three months, largely due to President Trump’s proposed tariffs on America’s neighbors. Nearly 17% of Ford’s U.S. sales reportedly come from Mexico.

Domestic rival GM reported strong Q4 results last week but saw its stock drop sharply after CEO Mary Barra raised concerns about uncertainty over Trump’s tariffs.

Analysts have also flagged potential risks for Ford, including inventory destocking and price normalization, which could negatively affect earnings in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260447662_jpg_cd246b74f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2254924116_jpg_d54ffea07e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228900989_jpg_e94daec744.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)