Advertisement|Remove ads.

First Solar Stock Surges As Harris Outshines Trump In First Debate, Retail Investors Go All In

Shares of First Solar, Inc. (FSLR) jumped nearly 12% on Wednesday, alongside other solar energy stocks, as Vice President Kamala Harris appeared to outperform former President Donald Trump in their first debate.

Investors believe a Harris win would boost the clean energy sector, buoyed by the passing of the Inflation Reduction Act (IRA) under the Biden-Harris administration, which provides funding for solar, wind, and other green energy initiatives.

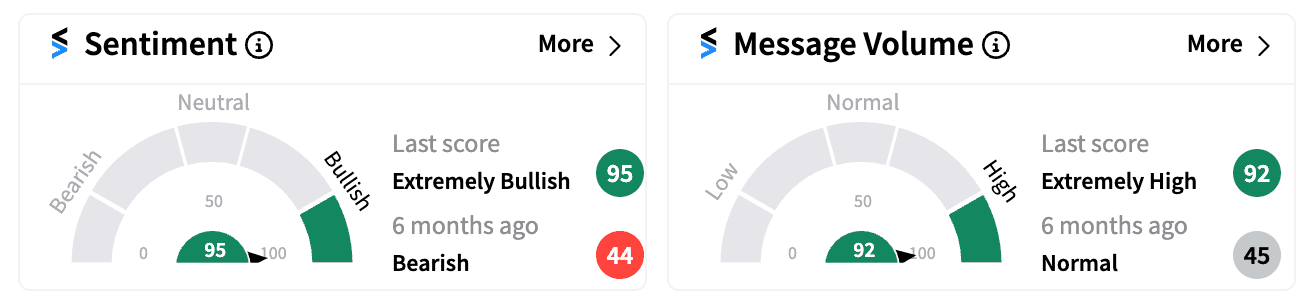

On Stocktwits, FSLR was among the top five trending tickers, with retail sentiment flipping to ‘extremely bullish’ from ‘bearish’ a day ago, while message volume surged to its highest level since the end of July.

“I am proud that as vice president over the last four years, we have invested a trillion dollars in a clean energy economy while we have also increased domestic gas production to historic levels,” Harris said during the debate.

Meanwhile, Trump criticized clean energy policies, stating, “We’ll go back to windmills and we’ll go back to solar, where they need a whole desert to get some energy to come out,” though he quickly added, “By the way, I’m a big fan of solar.”

The broader clean energy sector also gained. The Invesco Solar ETF (TAN) and the iShares Global Clean Energy ETF (ICLN) were last up over 5% and 2%, respectively, although they have significantly lost ground this year.

Other clean energy stocks joined the rally:

Company | Ticker | Stock Gain (%) |

Maxeon Solar Technologies Ltd | 14% | |

First Solar, Inc. | 12% | |

Sunrun Inc. | 8% | |

NextEra Energy | 7% | |

Sunnova Energy International Inc. | 6% | |

Solaredge Technologies Inc. | 6% | |

Enphase Energy Inc. | 4% |

Solar stocks have faced a tough year. High interest rates increased financing costs for solar panel installations, while lower demand, regulatory changes in key states, and growing inventories have clouded the industry outlook.

Raymond James analyst Ed Mills reportedly noted a “near-term bounce” in favor of Harris but highlighted uncertainty around the longer-term implications for the sector.

Meanwhile, Mizuho analysts have said that solar industry executives do not anticipate significant changes to the IRA, even in the event of a Republican sweep.

Still, retail investors remain optimistic about the sector’s long-term prospects, particularly under a Harris-led administration.

The U.S. presidential election is set for Tuesday, Nov. 5, and its outcome will be pivotal for the clean energy sector’s future.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)