Advertisement|Remove ads.

Fuzzy Panda Shorts New Era Energy & Digital Stock: ‘We Believe It Is Gray’s Next Flameout’

- The short seller added that the company’s CEO E. Will Gray II has a more than 20-year history of leading penny stock companies into collapse.

- Fuzzy Panda said NUAI spent 2.5 times more on stock promotion than on operating its 40-year-old gas wells.

- The short seller also indicated that insiders are preparing to sell all their shares.

Short seller Fuzzy Panda announced Friday it is short on New Era Energy & Digital (NUAI), citing concerns over its operations and management.

New Era Energy declined almost 4% on Friday morning but pared some of its losses. On Stocktwits, retail sentiment around the stock remained in ‘neutral’ territory amid ‘normal’ message volume levels.

Red Flags On Management and Operations

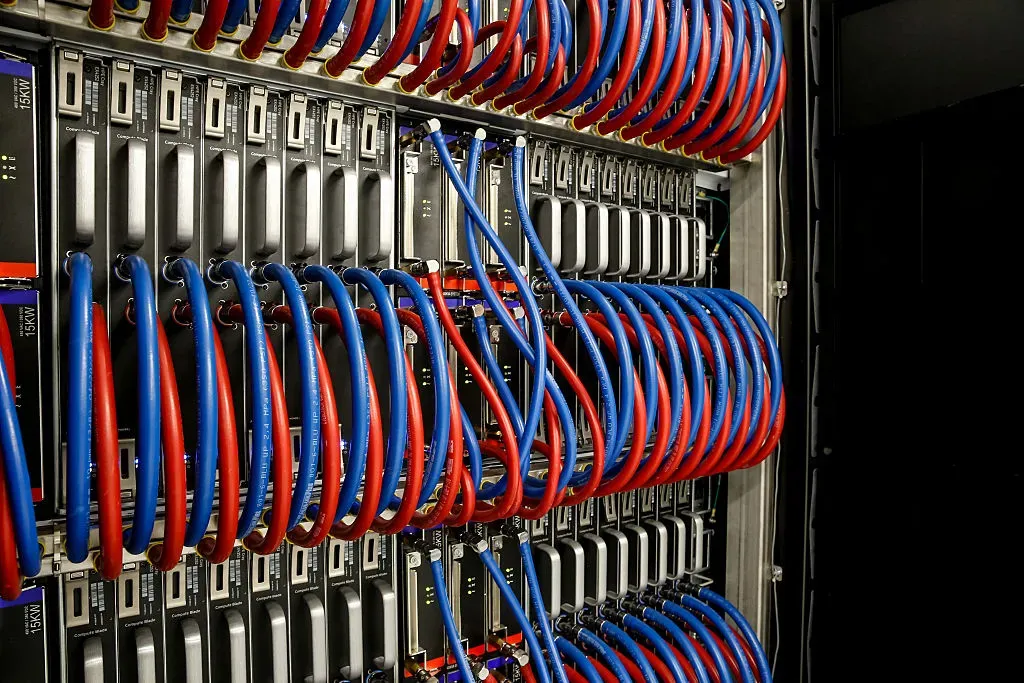

Fuzzy Panda alleged that the company’s claim that it aims to power AI data centers using aging gas wells is implausible and financially unsound.

The short seller added that the company’s CEO E. Will Gray II has a more than 20-year history of leading penny stock companies into collapse, often relying on paid stock promotions rather than sustainable business strategies.

“We are short NUAI because we believe it is Gray’s next flameout.”

-Fuzzy Panda

Fuzzy Panda said NUAI spent 2.5 times more on stock promotion than on operating its 40-year-old gas wells. Third-party analyses indicate these wells produce only about 5% of the output needed to support the company’s ambitious AI data center claims.

Questionable Related-Party Transactions

Fuzzy Panda has also highlighted issues regarding insider dealings. The firm stated that NUAI allegedly “loaned” significant cash to related parties, including former chairman Joel Solis, with minimal collateral and no recoveries.

Other transactions involved assets given as gifts and land purchases drastically above market value, suggesting potential enrichment of insiders at shareholders’ expense.

It said that concerns over governance are compounded by resignations, including the CFO and three out of four independent board members. The short seller indicated that insiders are preparing to sell all their shares, signaling a lack of confidence in the company’s future.

Also See: Why Is Actinium Pharmaceuticals Stock Rising Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_OG_2_jpg_f92901a0f5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Shift4_logo_jpg_jpg_1845f04c23.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)