Advertisement|Remove ads.

GameSpot Stock Draws Retail Buzz After Warrants Issue: Retail Investors Predict Short Squeeze

- GameStop is the top trending stock on Stocktwits early Wednesday.

- Retail watchers discuss the stock’s recent underperformance and the potential for a bounce and short squeeze.

- GameStop issued special warrants earlier this month, and investors are unsure of their impact on the stock.

GameStop Corp.’s stock was the top trending ticker on Stocktwits early Wednesday amid wide-ranging discussion about its performance and the company’s warrant issue.

Retail investors posted mixed comments, expressing frustration over the stock’s recent underperformance and hitting a bottom, as well as concerns over its financial moves. GME’s latest downward spiral began as it issued special warrants earlier this month, causing a 16.4% drop month-to-date.

Those warrants, distributed on Oct. 7, enable their holders to purchase GME stock at a pre-set $32 price until October 2026.

“$GME RC scammed y'all lol,” a user posed, referring to CEO Ryan Cohen and his warrants plan. However, another user defended the plan, saying that the warrants “eliminate the need for a dilutive offering during any short squeeze and add buy pressure when converted.”

“It’s a built-in, compliant way to strengthen the balance sheet and expose short positions,” they said.

GameStop’s shares closed 2.4% lower on Tuesday and gained marginally in the aftermarket session.

Yet another user shared a stock chart, noting the shares may be nearing a bottom and poised for a rebound.

Users were also anticipating a short squeeze, a sharp rally in a heavily shorted stock that could force short sellers to buy back shares and drive the price even higher. Short interest in the stock was 16.1%, near its highest level this year.

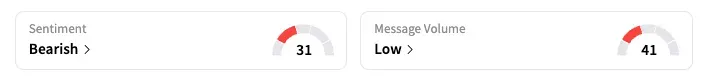

However, the broader view was still negative. On Stocktwits, retail sentiment for GME was ‘bearish’ as of early Wednesday, although it improved a few points from the previous day. Twenty-four-hour message volume for the ticker surged 70%.

Year-to-date, GME stock is down 27.3%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)