Advertisement|Remove ads.

Garmin Stock Records Best Day In 10 Months: CEO Calls 2025 ‘Another Remarkable Year’

- Garmin’s Q4 revenue increased 17%, led by sharp growth in its fitness segment.

- Strong performance due to market diversification and superior products - CEO

- Stocktwits sentiment for GRMN climbs to ‘extremely bullish.’

Garmin Ltd. shares ended 9.4% higher on Wednesday, their best single-day performance in over 10 months, after the fitness watch company forecast 2026 sales and profit above Wall Street’s targets.

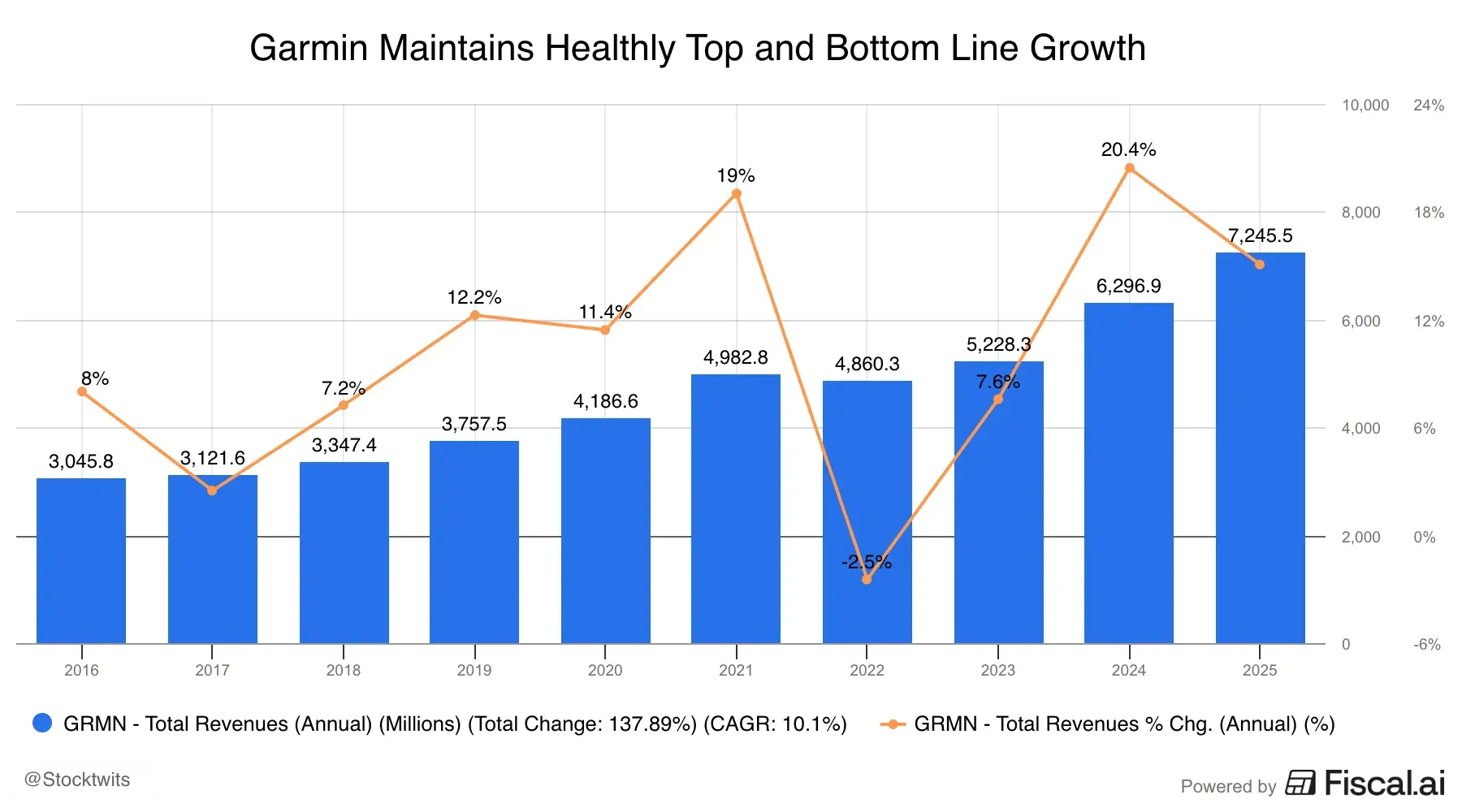

Garmin also beat expectations for the fourth-quarter top- and bottom-line. "2025 was another year of remarkable growth and achievement for Garmin with record consolidated revenue, record revenue in all five of our segments, and record consolidated operating income," said Cliff Pemble, President and CEO of Garmin.

"We attribute this strong performance to our strategic focus on market diversification and creating superior products that are essential to our customers’ lives."

Garmin Q4 Performance

Revenue jumped 17% to $2.12 billion in the December quarter, surpassing the $2.02 billion estimate. The upside was driven mainly by the fitness segment – spanning wearables, activity trackers, and the newly launched Venu 4 and Bounce 2 smartwatches – with revenue surging 42% to $765.8 million.

Garmin also sells navigation systems for aircrafts, watercrafts, and automobiles.

Adjusted profit came in at $2.79 per share, also ahead of $2.40 per share expectations.

For 2025, sales rose 15% to $7.2 billion and net income rose 18% to $1.7 billion.

2026 Outlook

Garmin expects total revenue of $7.9 billion this year, above analysts' expectations of $7.63 billion. Full-year earnings are seen at $9.35 per share, well ahead of the analysts’ consensus forecast of $8.70 per share.

Garmin also announced a 17% dividend increase to $1.05 per quarter.

Retail’s Reaction

On Stocktwits, the retail sentiment shifted to ‘extremely bullish’ (97/100) as of late Wednesday, from ‘bullish’ the previous day. Retail traders were debating whether the rally would hold, with some already booking profits.

“Secured profits from $152 - Nice day trade on the short. Will wait to see if it drops back further before making any more moves. I won't short again unless it rejects the new daily high, or if it bounces off the $230 range,” said a user.

With Wednesday’s rally, Garmin shares are up 17% year to date. They declined 3% in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2239867148_jpg_8df22810c1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347123_jpg_b7a8c29717.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236199359_jpg_28b0018e3a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199401088_jpg_656c1eacd4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_wall_street_sign_resized_f75f6c0a63.jpg)