Advertisement|Remove ads.

Gevo Stock Sinks After Q3 Earnings Miss: Retail Sentiment Falls

Shares of renewable chemicals and advanced biofuels maker Gevo Inc. ($GEVO) fell more than 18% on Friday morning after third-quarter results missed Wall Street estimates, pushing down retail sentiment.

The company reported Q3 loss per share of $0.09, worse than expectations of $0.08, while revenue of $1.97 million also fell below the estimated $5.43 million.

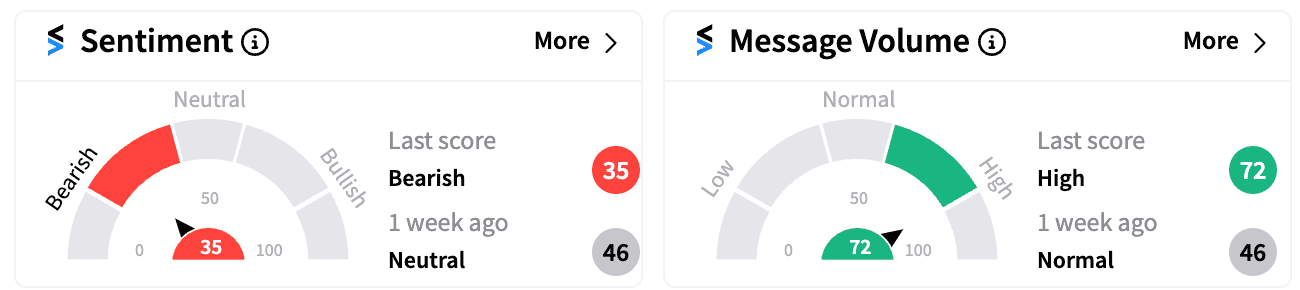

Retail sentiment for the stock turned ‘bearish’ from ‘neutral’ a week ago amid message volume climbing into the ‘high’ zone from ‘normal’.

“The progress on Net-Zero business systems, which include NZ1 and the Red Trail Energy asset acquisition, underscores our commitment to developing our businesses to abate carbon and serving enormous, growing markets,” CEO, Patrick Gruber, said in a statement.

“Our advancements in areas like Verity, with our CultivateAI acquisition, reflect our commitment to creating resilient value chains that support carbon abatement from field to flight, in the case of SAF, but also for other fuels, chemicals and food chains.”

Gevo’s Q3 growth milestones include a $1.63 billion conditional loan commitment from the U.S. Department of Energy for its Net-Zero 1 SAF project. That loan could be under threat with the new Trump administration, according to Bleecker Street Research, which noted a short position on the stock, The Fly reported.

Gevo was also granted two patents for its ethanol to olefin process, showcasing its innovation in sustainable fuel technology.

On the acquisition front, it agreed to buy Red Trail Energy's low-carbon ethanol and carbon capture sequestration assets, expected to close by Q1 2025.

Gevo stock is up 29.49% year-to-date.

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_unitedhealth_jpg_98f759065b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2022/09/Dmart-Gopikishan-Damani.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_austan_goolsbee_jpg_a506a85e18.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/sony-pictures-03oct-2025-10-7327663454d23bbb90b96ad5fc7a8c06.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_model_3_on_road_jpg_05119853eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2238140076_jpg_adf1228160.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)