Advertisement|Remove ads.

Globant Stock Tumbled 14% Today – Why JPMorgan’s Rating Downgrade Drew Investor Attention

JPMorgan downgraded Globant S.A.’s (GLOB) stock from ‘Overweight’ to ‘Neutral’ and slashed its price target to $78 from $108, citing weaker-than-expected revenue guidance for fiscal 2025 and mounting uncertainty in the company’s growth outlook.

The downgrade came in the wake of Globant’s second-quarter (Q2) earnings update, which signaled a slower growth trajectory ahead. The firm noted that the revenue projections create a more difficult environment for achieving positive growth by fiscal 2026.

The company lowered its FY2025 revenue outlook to at least $2.445 billion, from $2.464 billion earlier, in line with the consensus estimate, as per Fiscal AI data. Globat sees Q3 revenue of at least $615 million, also matching the consensus estimate.

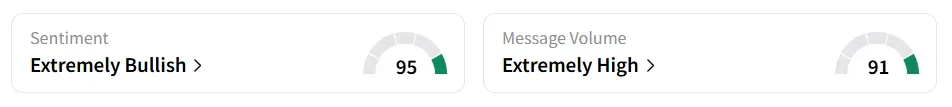

Globant S.A. stock tumbled over 14% on Friday mid-morning. However, on Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory while message volume improved to ‘extremely high’ from ‘high’ levels in 24 hours.

The stock saw an 860% surge in user message count in 24 hours, as of Friday morning. A bullish Stocktwits user said they are adding a small quantity of the stock.

In a note to clients, JPMorgan said that Globant’s previous reputation for delivering premium growth and consistent execution now appears ‘challenged.’ The firm pointed to macroeconomic headwinds and a delay in customers’ decision-making in an uncertain economic climate, which are weighing on investor confidence in the stock’s near-term potential.

“While we have delivered strong growth for many years, we have observed a more tempered demand environment over the last few quarters,” said CFO Juan Urthiague in the Q2 earnings call.

Globant S.A. stock has lost over 68% year-to-date and over 65% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)