Advertisement|Remove ads.

Can Musk–Trump Dinner Diplomacy Spark A Tesla Bounce After A Red Start To 2026?

- Tesla shares opened the new year on a dour note following a week of declines and a softer delivery update.

- Musk’s post about dining with Trump drew retail buzz over the weekend.

- Tesla is scheduled to report quarterly earnings on Jan.28.

Tesla, Inc. entered 2026 under pressure, posting its seventh consecutive loss on Friday, the first trading day of the year, marking a slide that was followed over the weekend by a post from CEO Elon Musk saying he had a “lovely dinner” with U.S. President Donald Trump and Melania Trump.

Elon Musk said in a post on X that “2026 is going to be amazing,” alongside a photo showing him seated next to Donald Trump and Melania Trump during a dinner at Mar-a-Lago, hours after Trump announced from the resort that Nicolas Maduro had been taken into U.S. custody.

Tesla shares fell about 2.6% to $438.07 on Friday as investors weighed fresh delivery data and intensifying competition.

Q4 Deliveries Decline

Tesla said it delivered 418,227 vehicles in the fourth quarter, down 16% year on year from 495,570 cars a year earlier and below the 422,850 vehicles expected by analysts, according to a company-compiled estimate.

For the full year, Tesla delivered 1.64 million vehicles, compared with 1.79 million in 2024, marking the company’s second consecutive annual decline in deliveries.

Additionally, Tesla said it deployed 14.2 GWh of energy storage products in the fourth quarter, a record level. The company reported deploying 11 GWh in the same period a year earlier.

BYD Records Higher Annual EV Sales

Tesla ceded its position as the world’s largest electric vehicle maker in 2025 to China’s BYD, after global EV sales rose 28% last year and BYD outsold Tesla on a full-year basis for the first time.

BYD delivered a total of 2.26 million pure EVs globally in 2025, adding that overseas sales, excluding China, had hit a record high of 1 million, up nearly 150% year-on-year. The company has set a goal of selling as many as 1.6 million vehicles outside China in 2026, without announcing an overall sales target.

Musk And Trump: A Volatile Bromance

Musk's recent interaction with Trump follows a public rupture last year that directly coincided with volatility in Tesla shares. In June, a dispute between Musk and Trump escalated into an open feud after the president threatened to withdraw federal contracts and subsidies from Musk’s companies amid disagreement over proposed tax legislation. The move sent Tesla shares down 14% in a single session, wiping out about $153 billion in market value and marking the stock’s worst day on record.

The shares later clawed back some ground toward the end of the year, helped by renewed optimism around Tesla’s full self-driving software updates, its robotaxi ambitions, and, to a lesser extent, progress on the Optimus humanoid robot program.

Wall Street Weighs Deliveries Ahead Of Earnings

Analysts’ views on Tesla’s delivery report were mixed. Dan Ives said that Tesla’s fourth-quarter deliveries came in slightly below consensus estimates but above “whisper numbers,” adding that investor focus remains on autonomy and artificial intelligence.

Meanwhile, Gary Black said he did not understand why the delivery report was viewed as bullish, noting that electric vehicles account for 77% of Tesla’s operating profits.

Tesla is scheduled to report quarterly earnings on Jan.28.

How Did Stocktwits Users React?

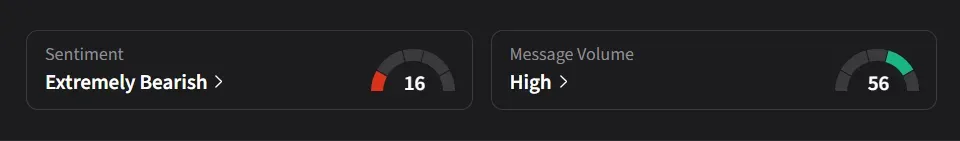

On Stocktwits, retail sentiment was ‘extremely bearish’ amid ‘high’ message volume.

One Stocktwits Tesla watcher mockingly wondered if the Biden-era EV tax credit, which was scrapped by Trump, was “back after the dinner?”

Another user said the stock was “already looking to nosedive before premarket even starts... Forget about $450 not happening tomorrow $430-428 more likely.”

Another user flagged several concerns about Tesla, citing lowered estimates following weaker deliveries, bearish technical signals, and uncertainty about near-term revenue from autonomy and robotics. While saying they remain long-term bullish, the user said early 2026 was not an attractive entry point and that they were looking for lower levels before reconsidering.

Tesla’s stock has risen 8.5% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)