Advertisement|Remove ads.

GlycoMimetics Stock Triples To Become Top Gainer On Crescent Biopharma Merger Deal: Retail Goes Wild

GlycoMimetics Inc.’s stock ($GLYC) skyrocketed over 200% on Tuesday, marking it the top gainer across U.S. markets as it reached a near two-year high.

The surge follows the announcement of an acquisition agreement with privately held Crescent Biopharma, along with a $200 million investment commitment from a syndicate led by Fairmount, Venrock Healthcare Capital, BVF Partners, and a large investment management firm.

Following the merger, the combined entity will operate under the Crescent Biopharma name.

The infusion of capital is expected to support operations through 2027, including the advancement of Crescent’s lead program, CR-001, a bispecific antibody targeting solid tumors.

Early clinical data for CR-001 is anticipated in the latter half of 2026.

GlycoMimetics shareholders are expected to hold approximately 3.1% of the merged company, with the transaction scheduled to close in Q2 2025.

In addition to CR-001, Crescent is progressing with CR-002 and CR-003, antibody-drug conjugates (ADCs) employing topoisomerase inhibitor payloads, known for their enhanced efficacy and safety over other ADC payloads.

An Investigational New Drug (IND) application for CR-001 is expected in Q4 2025 or early 2026.

GlycoMimetics also said it plans to evaluate its options for its late-stage leukemia treatment, Uproleselan, which failed to meet its primary target in recent trials.

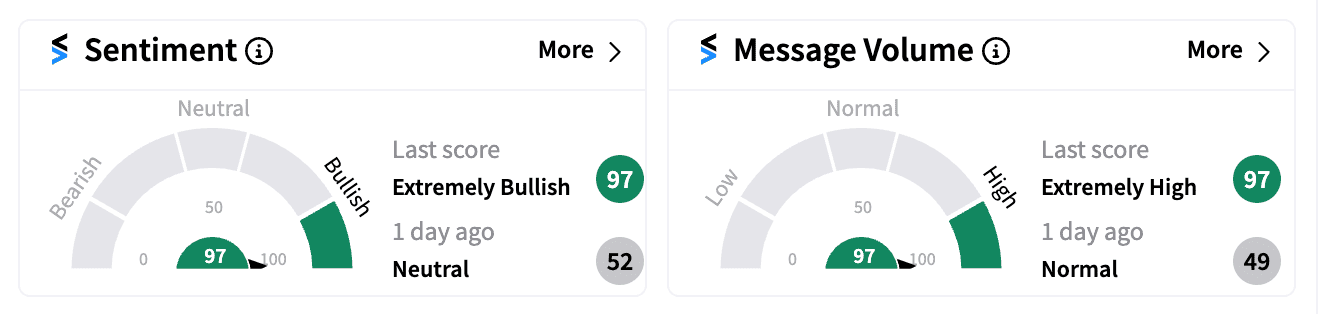

The acquisition announcement, however, has fueled a surge in retail enthusiasm on Stocktwits, making GLYC among the 20 most-discussed tickers of the day.

Sentiment score on the platform flipped to ‘extremely bullish’ (97/100) from ‘neutral’ a day ago.

The company’s cash position was $22.4 million as of June 30, compared to $58 million a year prior, with a net loss of $20.8 million for the first half of 2024.

GLYC is down over 80% year-to-date.

For updates and corrections, email newsroom@stocktwits.com

Read next: Trump Media Stock Halted For Volatility After 14% Jump, Set For 3rd Day Of Gains Amid Retail Frenzy

/filters:format(webp)https://images.cnbctv18.com/uploads/2023/08/NCLAT.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/11/hotel-2024-11-f33f62bd5f3c7a8bc9d013498f1a9451.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/07/fmcg-2025-07-e7617746bdd21411be4c76398e746d42.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/09/gold-silver-2025-09-3e800c1232631c1df9890a1871ebb271.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2023/06/GE-Aerospace-1.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/12/hdfc-2024-12-4bb9da47ed7c145a6b6eaca2bcfc4159.jpg)