Advertisement|Remove ads.

Trump Auto Tariffs: GM, Ford, Volvo Face New Roadblocks Amid Wavering Retail Sentiment

Donald Trump's tariffs on imported automobiles are starting to bite established carmakers, even as the U.S. president has floated the idea of delaying levies to help Detroit's 'Big Three.'

According to a Reuters report from the weekend, General Motors will likely face imminent turbulence over sales of its popular Buick models, especially top-selling SUVs priced under $30,000, as they are all made outside the United States.

The Buick Envista and Encore GX are reportedly made in South Korea, while the Envision SUV is made in China, and Trump's tariffs could add thousands to sticker prices on dealer lots.

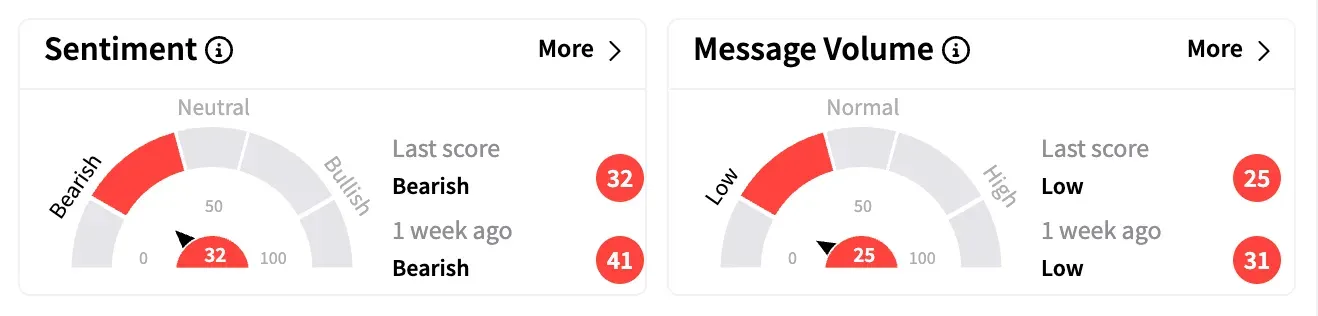

Stocktwits sentiment for GM fell deeper into 'bearish' levels over the past week even as the stock rose nearly 2.5%.

"GM is part of the reason all this crap happened. Building 1/2 their cars on foreign land," said one skeptical user. "After all these years, they couldn't figure out how to build domestically, but Tesla did in just a few."

The Wall Street Journal reported that Ford stopped shipping some pickup trucks, SUVs and sports cars to China last week to avoid increased tariffs.

The export adjustment follows China's countermeasures in response to U.S. import taxes, which have pushed tariffs on those vehicles as high as 150%.

Halted shipments reportedly include F-150 Raptors, Mustang muscle cars, Bronco SUVs built in Michigan, and Lincoln Navigators made in Kentucky — businesses representing a small but profitable operation for Ford.

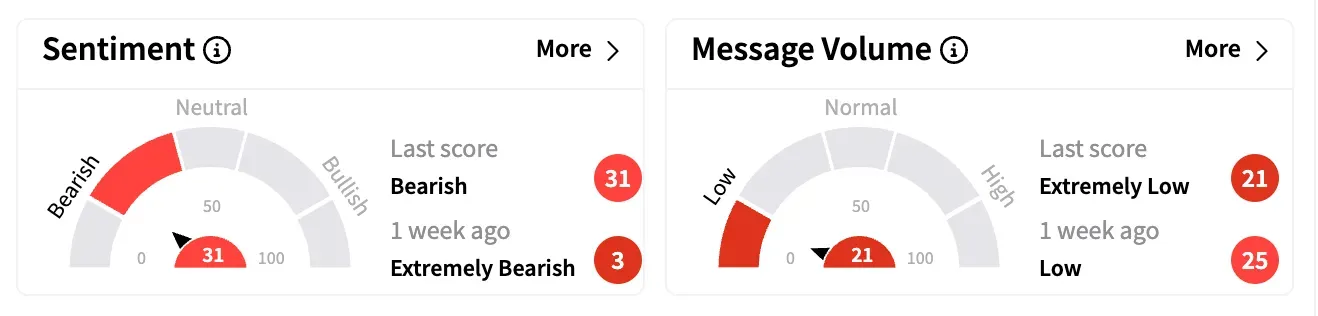

Stocktwits sentiment for Ford turned less bearish over the past week, although message volume indicated a dip in retail buzz.

"So they stopped shipping to China. No big deal. China sales only accounted for about 9% of its sales last year," said one user.

Meanwhile, Swedish auto giant Volvo Group has decided to take stronger measures.

According to Reuters, the company, owned by China's Geely Holding, is preparing to lay off as many as 800 workers across three U.S. sites (in Pennsylvania, Virginia and Maryland) amid increased uncertainty over the impact of tariffs.

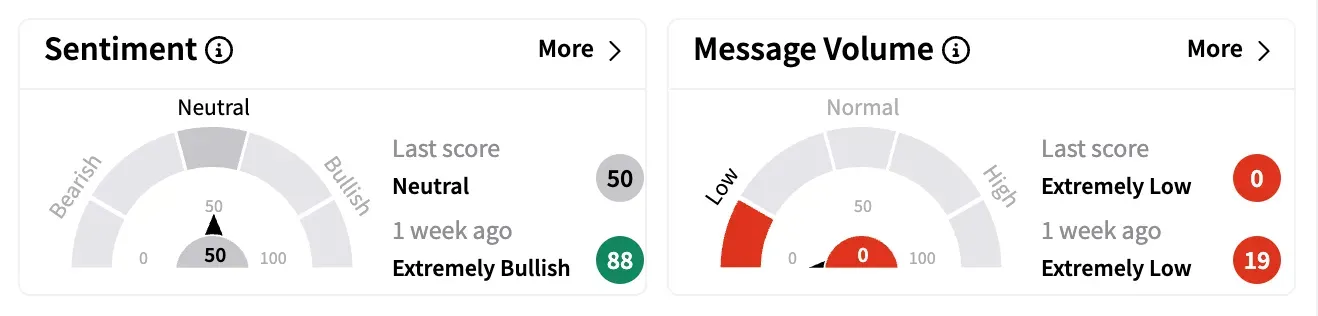

Retail sentiment for the company dipped into 'neutral' levels from 'extremely bullish' over the past week, although chatter levels crashed.

Year to date, GM's stock has lost over 16.4%, Ford's has dipped more than 2.8%, while Volvo's U.S.-listed shares have gained over 8%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump2_jpg_ad63f384b5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_GE_Aerospace_resized_1_jpg_03f4fd7e4e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260447662_jpg_cd246b74f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2254924116_jpg_d54ffea07e.webp)