Advertisement|Remove ads.

Gold Climbs But Bitcoin Outperforms Amid Surge In Safe-Haven Demand During Trump’s Tariff Crackdown

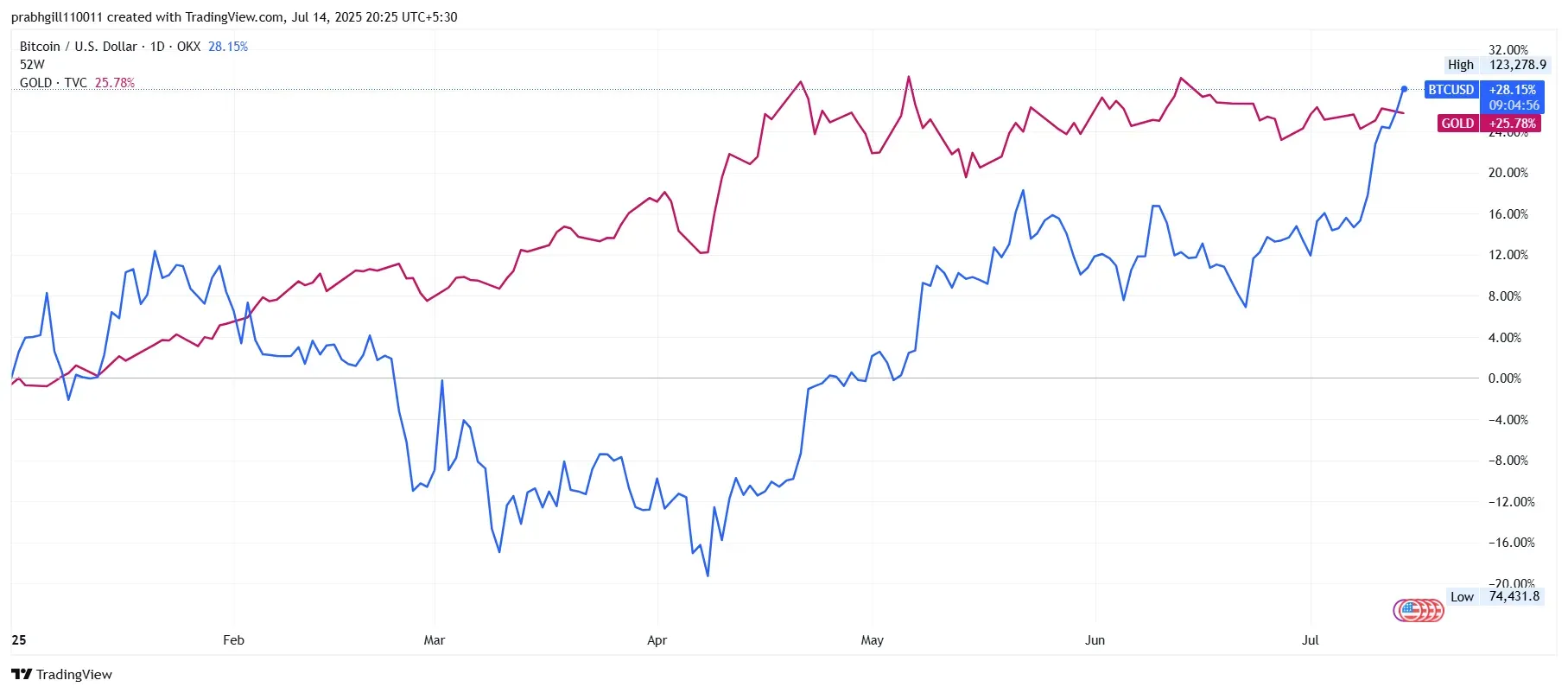

Gold’s price was steady Monday morning after the precious metal hit a three-week high during pre-market hours as traders looked for more developments around President Donald Trump’s trade war. However, its year-to-date gains lagged behind the digital safe haven, Bitcoin (BTC).

Gold price was trading at around $3,344 in midday trade after hitting a high of $3,374.9 earlier in the day. The precious metal’s value has grown 25% so far this year. In comparison, Bitcoin’s price topped $123,000 in pre-market hours and is up more than 28% on the year, regaining its lead after a volatile first half.

The SPDR Gold Shares ETF (GLD) edged 0.3% lower in midday trade, while the iShares Bitcoin Trust (IBIT) was up 1.3%.

Bitcoin outperformed gold in January, but has only gained the upper hand again after last week’s rally. The stronger showing for Bitcoin follows renewed momentum in recent days, fueled in part by Trump’s latest tariff threats.

On Saturday, the U.S. President pledged to impose a 30% tariff on most imports from the European Union and Mexico starting next month. South Korea and the EU said they were working with Washington to strike separate trade deals, while Japan and other partners await further details.

The broader market remains focused on key U.S. inflation data due this week, with the Consumer Price Index set for Tuesday and the Producer Price Index on Wednesday, both critical to assessing the Federal Reserve’s rate outlook.

Charlie Bilello, chief market strategist at Creative Planning, told CoinDesk that Bitcoin and gold are currently the top-performing assets of 2025. “We’ve never seen these two in the number one and number two spots for any calendar year,” he said. Their joint rally may reflect deeper economic unease. Historically, outperformance by gold and Bitcoin has signaled investor defensiveness rather than confidence in risk assets.

Meanwhile, the U.S. Dollar Index (DXY) has dropped 9% so far this year amid rising geopolitical tensions and Trump’s trade war.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994915_jpg_357c625963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1470886126_jpg_f11dd80298.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)