Advertisement|Remove ads.

Gold Price Falls Below $4,000 For The First Time Since Trump Threatened ‘Massive’ Tariff Hikes On China

- Spot gold prices were hovering at $3,983 per troy ounce, while gold futures maturing in December declined 3.4% to fall to $3,996 before recouping some of the losses.

- Gold prices are now down by more than 9% since surging to an all-time high of $4,381 earlier in October.

Gold prices fell below the $4,000 mark for the first time since October 10, when President Donald Trump threatened “massive” tariff hikes on China.

Spot gold prices were hovering at $3,983 per troy ounce at the time of writing, declining by more than 3%. Gold futures maturing in December declined 3.4% to fall to $3,996 before recouping some of the losses.

Gold prices are now down by more than 9% since surging to an all-time high of $4,381 earlier in October.

Easing China Trade Tensions

The softening in gold prices comes as trade tensions with China cool down. Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer led the U.S. delegation for the fifth round of talks between the United States and China. “I think we’ve reached a substantial framework for the two leaders who will meet next Thursday,” Bessent said on ABC, following the meeting.

President Donald Trump and his Chinese counterpart, President Xi Jinping, are scheduled to meet on Thursday.

Time To Buy

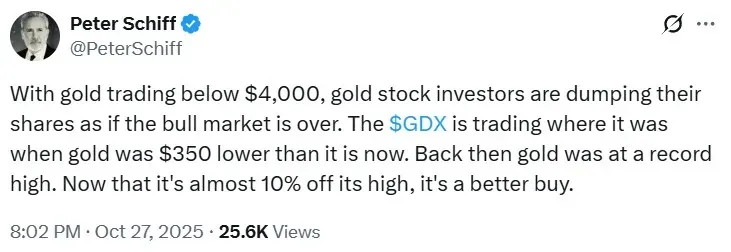

Economist Peter Schiff thinks that after the correction in gold prices, now is a good time to buy the yellow metal.

“With gold trading below $4,000, gold stock investors are dumping their shares as if the bull market is over. The $GDX is trading where it was when gold was $350 lower than it is now. Back then gold was at a record high. Now that it's almost 10% off its high, it's a better buy,” Schiff said in a post on X.

Meanwhile, the SPDR Gold Shares ETF (GLD) was down 2.98% at the time of writing, while the iShares Gold Trust ETF (IAU) fell 2.9%. The GLD and IAU ETFs have both surged 52% year to date. Retail sentiment on Stocktwits around the GLD ETF was trending in the ‘extremely bullish’ territory at the time of writing.

Also See: Tesla Chair Warns EV Maker Could Lose Elon Musk If $1 Trillion Pay Package Is Not Approved

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_540198451_jpg_3e5f3d8ee7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202831815_jpg_e9c998f956.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_b1a99c6298.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243572319_jpg_90770a5e51.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_Social_logo_1200_Px_resized_jpg_86883cac04.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243387433_jpg_9712a99e81.webp)