Advertisement|Remove ads.

Gold Prices Surge To New Record High, Inch Closer To $4,000: Expert Warns It’s A Sign Of Equity Bust Worse Than Dotcom Bubble

Gold prices continued to climb on Monday, surging to a new record high as the U.S. government shutdown entered its sixth day.

Spot gold prices climbed to a new high of $3,970 per troy ounce, surging by more than 2.1% before paring some of the gains. Gold futures maturing in December gained 1.75% to hover around $3,977 at the time of writing.

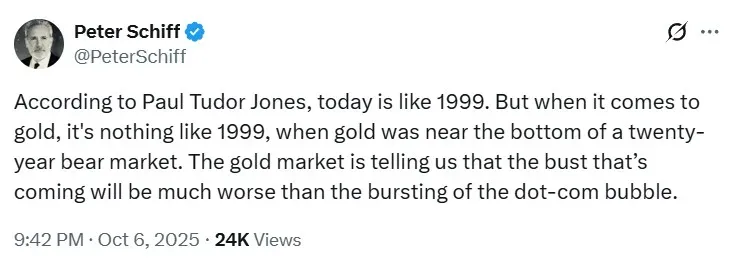

Economist Peter Schiff warned that the rally in gold prices is signaling an impending bust in the equity market. “But when it comes to gold, it's nothing like 1999, when gold was near the bottom of a twenty-year bear market. The gold market is telling us that the bust that’s coming will be much worse than the bursting of the dot-com bubble,” Schiff said in a post on X.

Gold prices have surged nearly 51% year-to-date, crossing the $3,000 level for the first time in March. Since then, the price of the yellow metal has soared by nearly 33%.

According to a Reuters report, Marex analyst Edward Meir said that the current rally is driven by the U.S. government shutdown, political upheaval in France, and rising Japanese yields. “The fact that we're so close to $4,000/oz also suggests that some of the funds might be trying to push it up to get to that mark,” Meir stated.

The report added that UBS analysts now expect gold prices to reach $4,200 per ounce by the end of 2025.

Meanwhile, U.S. equities were mixed in Monday’s afternoon trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was up 0.36%, the Invesco QQQ Trust ETF (QQQ) gained 0.8%, while the SPDR Dow Jones Industrial Average ETF Trust (DIA) fell 0.22%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘bearish’ territory.

The SPDR Gold Shares ETF (GLD) was up 1.79% at the time of writing, while the iShares Gold Trust ETF (IAU) was up 1.8%. The GLD and IAU ETFs have both surged nearly 50% year-to-date.

Also See: AMD, Critical Metals, Verizon, Comerica, Hive Digital: Stocks Making The Biggest Moves Today

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Array_Tech_b34d437c86.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1238344200_1_jpg_9ec6a1a77a.webp)