Advertisement. Remove ads.

Goldman Sachs Stock Rises On Strong Q3 Results: NII Soars 70%, Investment Banking Fees Up 20%

Goldman Sachs Group (GS) on Tuesday reported better-than-expected quarterly revenue and earnings, supported by a significant rise in net interest income (NII) and a boost in investment banking earnings.

Revenue for the third quarter stood at $12.7 billion compared to an estimate of $11.757 billion while earnings per share (EPS) came in at $8.4 versus an estimate of $7.31.

Goldman highlighted that the 7% year-over-year (YoY) increase in net revenue was driven by growth in Global Banking & Markets and Asset & Wealth Management, partially offset by a decline in Platform Solutions.

NII, the difference between interest earned and interest expended, rose 70% YoY to $2.62 billion, reflecting an increase in interest-earning assets.

The bank witnessed a 20% YoY surge in Investment banking fees to $1.87 billion, driven by significantly higher net revenues in debt and equity underwriting.

At the same time, net revenues in Asset & Wealth Management rose 16% YoY to $3.75 billion, led by net gains in Equity investments compared with net losses in the prior year period and higher management and other fees.

However, the lender reported a huge increase in provisions for credit losses, which rose to $397 million during the third quarter from $7 million a year earlier and $282 million in the prior quarter.

On Oct. 11, the board of directors declared a dividend of $3 per common share to be paid on Dec. 30, 2024.

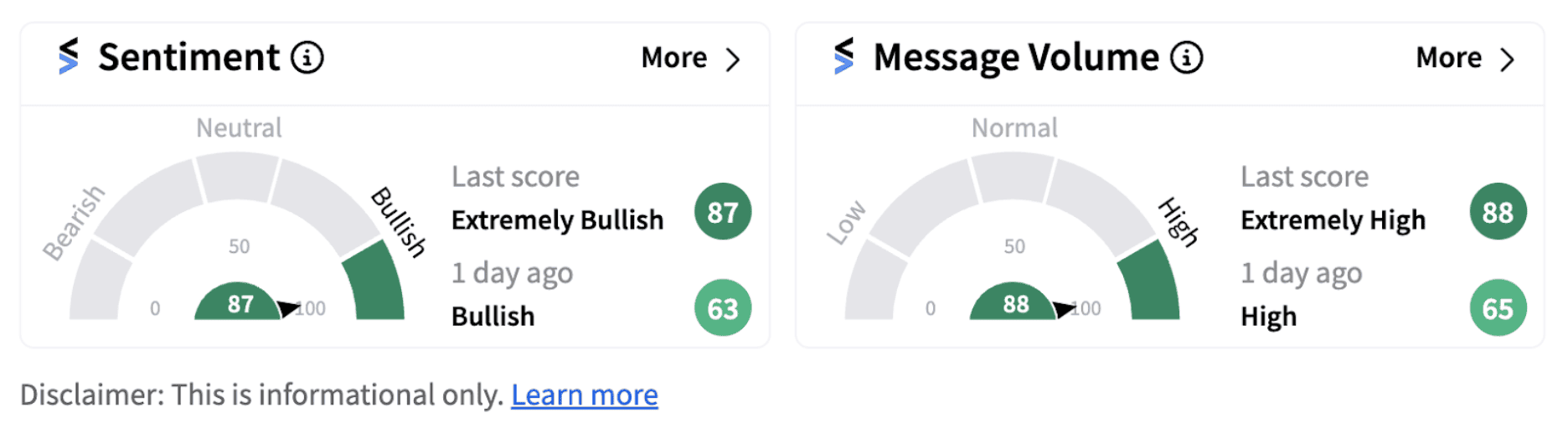

Following the report, shares of Goldman were trading over 3% higher in Tuesday’s pre-market while retail sentiment on Stocktwits inched up into the ‘extremely bullish’ territory (87/100) from ‘bullish’ a day ago.

Stocktwits users with a bullish outlook on the firm are expressing optimism on the stock.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/10/pg-hygiene-2024-10-1758fd0b5cd7355b37bdcee639ae3b9c.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2022/12/Asian-Paints.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/09/2025-09-01t102230z-1330264643-rc2tggavkfan-rtrmadp-3-india-economy-tax-2025-09-59bc981d166ef04b87ddaa420db4400d.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/09/gst-new-2025-09-ab01588cdd4ac9aa6e2fb4224e3a0e5b.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/06/udaipur-marriott-hotel-2025-06-c90ea0b4643ce396939f588235726d62.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/09/gst-2025-09-8e3e802cf9336791ed2a213f0ab5610d.jpg)