Advertisement|Remove ads.

Goldman Sachs Trims Netflix Price Target Ahead Of Earnings – The New Level Still Leaves A Good Upside Potential

- The firm expects growth to come from investments in original programming, live entertainment events, and gaming expansion.

- According to a Bloomberg report, the stock trades at roughly 28 times expected earnings over the next 12 months.

- Netflix is expected to report its fourth-quarter earnings on January 20.

Goldman Sachs has reduced its price target for Netflix Inc. (NFLX) to $112 from $130 while maintaining a ‘Neutral’ rating on the stock as investors weigh the streaming giant’s shift toward potential acquisitions over core subscriber growth.

The firm highlighted that the streaming giant’s stock has fallen roughly 27% since the company’s last earnings report.

Content And Technology Growth

Goldman Sachs emphasised that the stock’s decline reflected concerns about prioritizing content-related acquisitions from Warner Bros. Discovery (WBD) over organic expansion.

According to the firm, growth is expected to come from investments in original programming, live entertainment events, and gaming expansion.

Goldman Sachs also pointed to improvements in the company’s technology infrastructure and the adoption of digital advertising as key drivers for revenue growth. Netflix stock inched 0.3% lower in Friday’s premarket.

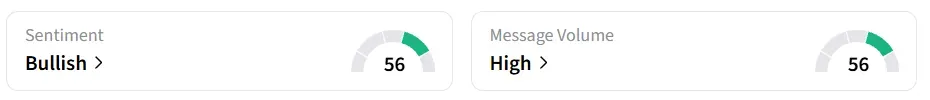

However, on Stocktwits, retail sentiment around the stock jumped to ‘bullish’ from ‘neutral’ territory amid ‘high’ message volume levels.

Stock Performance And Valuation

According to a Bloomberg report, while Netflix stock has dropped significantly from its June 30 high, its current valuation is actually below its five-year average multiple of 34.

The report also noted that the stock trades at roughly 28 times expected earnings over the next 12 months, higher than peers such as Walt Disney (DIS), Amazon (AMZN), and Alphabet (GOOGL).

It drew attention to the fact that the market’s focus currently has shifted to the $82.7 billion potential Warner Bros. (WBD) acquisition, which would merge Netflix’s streaming platform with Warner Bros.’s content library and HBO Max.

Warner Bros. Acquisition

After the Netflix-Warner Bros. deal was announced in December, Paramount Skydance made an all-cash offer of $30 per share, which would cover all of WBD, including its Global Networks division, stating it is ‘superior’ to Netflix’s deal.

However, Warner Bros called Paramount’s offer “illusory,” adding that it cannot be completed before its current expiration date, reinforcing support for its merger with Netflix.

Netflix is expected to report its fourth-quarter earnings on January 20. Analysts expect the company to post a revenue of $11.96 billion and earnings per share of $0.55, according to Fiscal AI data.

NFLX stock has gained 8% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_micahel_saylor_OG_2_jpg_286b612773.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2208523880_jpg_5bfb5acfa2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234552872_jpg_457b0ca1ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sandisk_jpg_920fcc1fc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_So_Fi_new_6d7889a863.webp)