Advertisement|Remove ads.

Government Shutdown Could Cost US Economy Up To $14 Billion, According To Congressional Budget Office

- The ongoing federal government shutdown could cost the U.S. economy between $7 billion and $14 billion, CBO says.

- CBO expects the economy to struggle due to delayed spending on employee compensation, goods and services, and the suspension of benefits for low-income Americans.

- Nearly 750,000 federal employees have been furloughed since government funding expired on October 1.

The ongoing federal government shutdown could cost the U.S. economy between $7 billion and $14 billion, according to the nonpartisan Congressional Budget Office. The shutdown, which has entered its 29th day, could trim up to 2% from fourth-quarter GDP in 2025, it said.

While most of the lost output may eventually be recovered, the CBO projects a permanent hit of up to $14 billion if the shutdown stretches through November.

CBO expects the economy to struggle due to delayed government spending on employee compensation, goods and services, and the suspension of benefits such as food stamps for low-income Americans.

In a letter to House Budget Committee Chair Jodey Arrington, CBO Director Phillip Swagel noted that the actual economic toll remains uncertain and will depend on administrative decisions during the funding lapse.

The CBO outlined three possible outcomes — if the shutdown ends this week, the economy would lose about $7 billion but if it extends until November 12, it could raise the losses to $11 billion, and a prolonged closure through November could bring total losses to $14 billion.

Impact on Federal Jobs

The shutdown has come at a cost to nearly 750,000 federal employees who have been furloughed since government funding expired on October 1. While the Trump administration has ensured continued pay for U.S. troops, law enforcement, and immigration officers, many other federal workers remain on the job without pay.

The shutdown has further exposed political rifts in Washington. Senate Republicans are pushing Democrats to back a short-term funding measure to keep the government open through November 21.

Democrats, however, insist on broader negotiations to extend Affordable Care Act tax credits and renew key nutrition programs like SNAP and WIC, arguing that the standoff is needed to secure longer-term funding and protect vital benefits.

How Are The Markets Doing?

U.S. equities edged higher in afternoon trade on Wednesday.

The SPDR S&P 500 ETF (SPY) was up 0.11%, the SPDR Dow Jones Industrial Average ETF (DIA) gained 0.2%, and the Nasdaq-100 tracking Invesco QQQ Trust (QQQ) moved 0.28% higher.

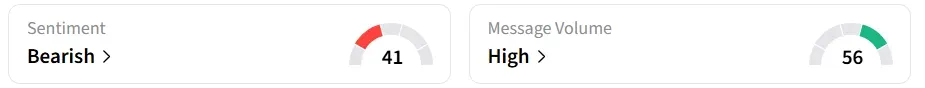

Retail sentiment around QQQ on Stocktwits remained ‘bearish’. It was ‘extremely bearish’ last week.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Shift4_logo_jpg_jpg_1845f04c23.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ras_tanura_jpg_b79d6fe085.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)