Advertisement|Remove ads.

Gran Tierra Energy Reports Losses In Q4, CEO Says 2025 Set To Be Transformational Year: Retail’s Hopeful

Shares of Gran Tierra Energy Inc (GTE) were in the spotlight on Monday after the company failed to meet Wall Street earnings expectations.

Gran Tierra reported a loss of $1.04 per share during the fourth quarter compared to an estimated profit of $0.03. The company’s net loss for the quarter stood at $34.21 million compared to a profit of $1.13 million in the same quarter a year ago.

In 2024, the company achieved average working interest (WI) production of 34,710 barrels of oil equivalent per day (boepd), representing a 6% increase from 2023. This was driven by positive exploration results in Ecuador and two months of production from Canadian operations acquired on Oct. 31, 2024.

The gains were partially offset by lower production in the Acordionero field due to downtime related to work-overs and deferred production from blockades in Suroriente during the quarter.

For 2024, the company realized a net income of $3.2 million, compared to a net loss of $6.3 million in 2023. Adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) decreased 8% to $366.8 million, commensurate with the decrease in the Brent oil price.

CEO Gary Guidry said 2025 is set to be a transformational year for the company as it advances exploration drilling in Ecuador.

“We are excited about the prospects of our 2025 exploration initiatives in Ecuador and Colombia, where we are set to drill between 6 to 8 high-impact exploration wells in our base case. These prospects have the potential to be significant catalysts in our commitment to unlock new reserves and drive sustainable growth,” he said.

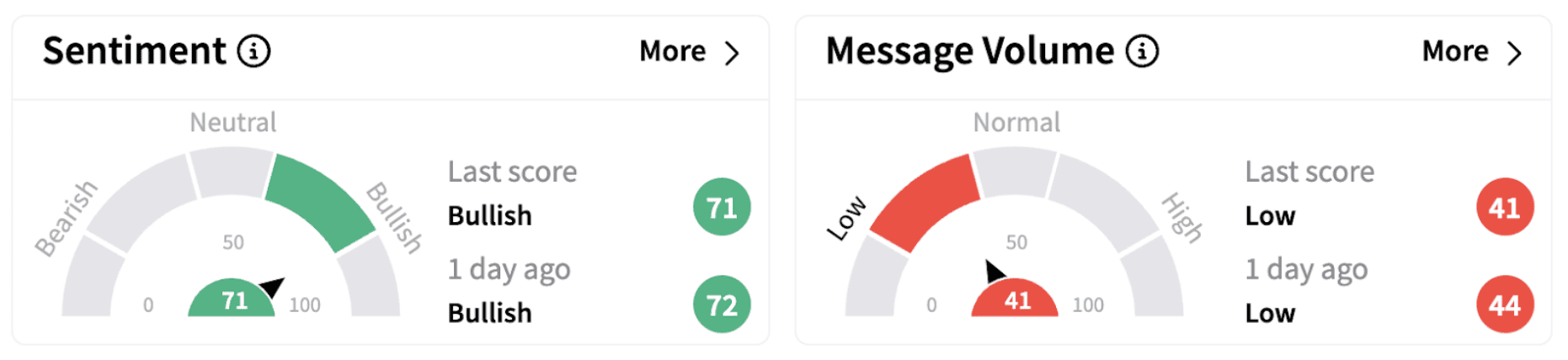

On Stocktwits, retail sentiment continued to trend in the ‘bullish’ territory.

Gran Tierra Energy shares lost nearly a quarter of its market capitalization in 2025 but gained almost 6.5% over the past year.

Also See: Kosmos Energy Reports Upbeat Revenue But Posts Wider-Than-Expected Loss: Retail’s Optimistic

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ras_tanura_jpg_b79d6fe085.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)