Advertisement|Remove ads.

Guess Stock Rises After WHP Global Proposes Take-Private Deal: Retail Sentiment Upbeat

Shares of Guess Inc. (GES) surged 30% on Monday after the company said it received a go-private proposal from an affiliate of WHP Global, lifting retail sentiment.

WHP Investments has offered to pay $13.00 per share in cash for the outstanding shares of Guess other than shares held by certain existing shareholders, including Paul Marciano, Maurice Marciano and Carlos Alberini, according to a company statement.

According to a Reuters report, the trio owns roughly 43% of the company.

The proposal would reflect a premium of 34% to the company’s stock closing price on Friday.

There is no guarantee that any definitive offer will be made, according to a company statement.

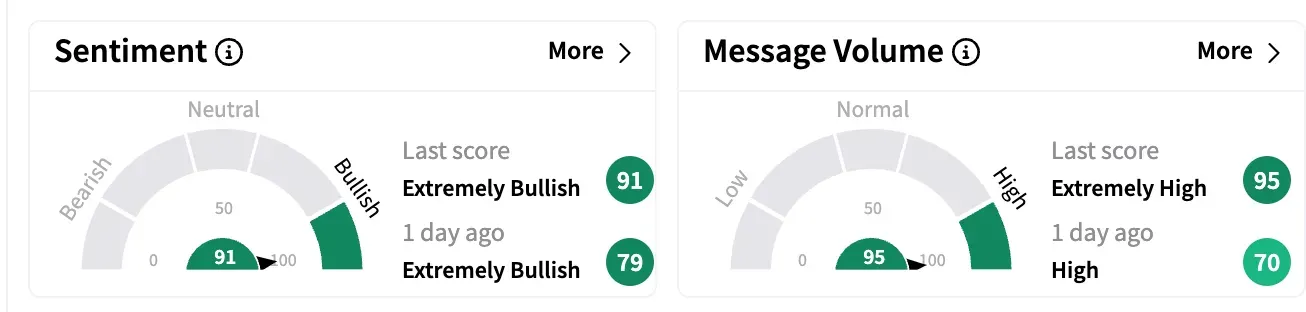

Retail sentiment on Stocktwits was ‘extremely bullish’ on Monday. Message volume was in the ‘extremely high’ zone.

The proposed transaction would be funded by a combination of equity and third-party debt financing, said the company. It also includes rollover equity from certain shareholders.

In April 2024, Guess partnered with WHP Global to acquire the intellectual property and operating assets of New York-based fashion brand rag & bone.

Guess now directly operates rag & bone stores in the U.S. and in the U.K.. As of Nov. 2, Guess had 1,057 retail stores in Europe, the Americas and Asia.

The company’s stock is down 12% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)