Advertisement|Remove ads.

Gujarat Pipavav Gains After ONGC Contract; SEBI Analyst Sees Buying Opportunity

Gujarat Pipavav shares gained over 2% on Thursday after the company secured a contract from ONGC to provide port and storage facilities at Pipavav Port for a period of five years, commencing on October 1, 2025.

This will enable ONGC to establish its offshore supply base at the Gujarat Pipavav port. The notification letter from ONGC will be formalized into a binding agreement between the two parties.

In an exchange filing, the company said, “Gujarat Pipavav Port Limited has received a letter dated September 24, 2025, from ONGC notifying of the award of contract for hiring the port and storage facilities at Pipavav Port for a period of five years from 1st October 2025.”

Gujarat Pipavav Port, operated by APM Terminals, is India's first private-sector port, located on the southwest coast of Gujarat, near Bhavnagar.

Technical Outlook

SEBI-registered analyst Ashok Kumar Aggarwal of Equity Charcha noted that Gujarat Pipavav stock is under consolidation and trading in a range, so a conditional buy can be initiated.

He recommended a short-term to medium-term play, advising traders to buy if the stock closes above ₹168.50-₹169 today, with a stop-loss at ₹149, targeting prices of ₹189-₹210.

What Is The Retail Mood?

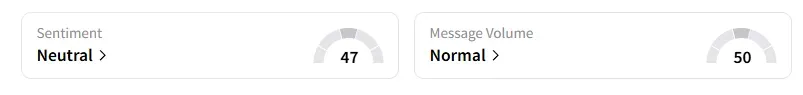

Data on Stocktwits shows that retail sentiment has improved to ‘neutral’ from ‘bearish’ last week.

Gujarat Pipavav shares have fallen 13% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)