Advertisement|Remove ads.

Halliburton Stock Surges Most In Over 6 Months On AI Data Center Push, Upbeat Q3 Earnings

- HAL stock recorded its best day since early April, and closed as the second-biggest gainer among S&P 500 companies.

- On an adjusted basis, the company reported earnings of $0.58 per share for the third quarter, while analysts expected $0.51 per share, according to Fiscal.ai data.

- The company announced a collaboration with distributed power solutions firm VoltaGrid to power data centers, with the initial rollout targeted for the Middle East.

Halliburton (HAL) stock rose 11.6% on Tuesday after the oilfield technology firm topped Wall Street’s estimates for quarterly earnings and announced its foray into data center power generation.

The stock recorded its best day since early April, and closed as the second-biggest gainer among S&P 500 companies. About 39.66 million Halliburton shares changed hands on Tuesday, the highest in seven months, according to Koyfin data.

On an adjusted basis, the company reported earnings of $0.58 per share for the third quarter, while analysts expected $0.51 per share, according to Fiscal.ai data. Its revenue of $5.60 billion for the three months ended Sept. 30 also topped estimates of $5.39 billion.

Separately, the company announced its collaboration with distributed power solutions firm VoltaGrid to power data centers, with the initial rollout targeted for the Middle East. As per the agreement, the two companies expect to provide power generation systems utilizing turbines, reciprocating engines, and VoltaGrid’s proprietary QPac platform.

Why Is Halliburton Moving Into AI Data Center Power Supply?

The deal with VoltaGrid marked the first significant move by Halliburton into the data center power generation sector, amid a surge in global demand for electricity. U.S. data centers will require 22% more grid power by the end of 2025 than they did one year earlier, and will need nearly three times as much in 2030, according to a report by the S&P Global.

Halliburton’s peers, including Baker Hughes, SLB, and Liberty Energy, have all expanded their offerings to cater to the growing market. Last week, VoltaGrid announced an agreement to deploy 2.3 gigawatts of generation capacity in support of Oracle's next-generation artificial intelligence data centers. Halliburton owns 20% of VoltaGrid.

This also comes amid uncertainty in its core oilfield services business, as volatile commodity prices and a worrying economic growth outlook have forced oil and gas drillers to put a tight lid on spending. Halliburton projected a 12% to 13% sequential decline in North America revenue in the fourth quarter, flagging that North American oil clients are investing below the so-called maintenance levels.

What Is Retail Thinking?

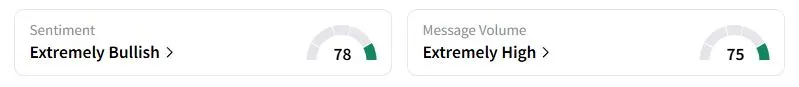

Retail sentiment on Stocktwits about Halliburton was in the ‘extremely bullish’ territory at the time of writing, while retail chatter was ‘extremely high.’

"Unseen AI play???? Watch out!!!” one user wrote.

What Are Analysts Saying?

“Data center collaboration with VoltaGrid is a surprise and likely more impactful to stock than the upbeat third-quarter earnings,” said Marc Bianchi, a TD Cowen analyst, in a note.

Separately, RBC Capital Markets analyst Keith Mackey upgraded Halliburton to ‘Outperform’ from ‘Sector Perform’ and gave a price target of $31, up from $26. The new price target implies a 22.8% upside from the last closing price.

Halliburton shares have fallen nearly 9% this year, compared with marginal gains of the Energy Select Sector SPDR Fund.

Also See: Why Did Capital One Stock Rise After-Hours Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)