Advertisement|Remove ads.

Has Roblox’s Viral Growth Faded? JPMorgan Sees Rough Waters Ahead

- JPMorgan acknowledged that Roblox saw robust engagement during 2025 due to breakout experiences.

- The firm said the viral hits have peaked, leading to a moderation in active user interaction.

- The firm highlighted three key risks: engagement cooling, slower growth in bookings, and pressure on profit margins.

Roblox Corp. (RBLX) stock slid 2% in Friday’s premarket after JPMorgan downgraded the online gaming platform, citing weakening user engagement and slowing growth prospects.

The firm downgraded the stock to ‘Neutral’ from ‘Overweight’ and slashed the price target to $100 from $145, according to TheFly.

Analyst Rationale

JPMorgan acknowledged that Roblox saw robust engagement during 2025 due to breakout experiences such as ‘Grow a Garden’ and ‘Steal a Brainrot’, which helped drive bookings growth above its annual target.

However, data suggested that most of these viral hits have peaked, leading to a moderation in active user interaction and raising questions about sustainability, the firm added.

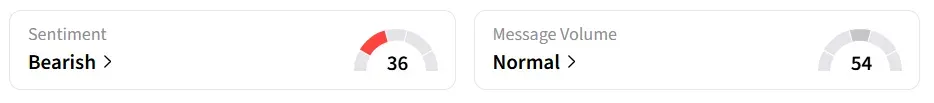

On Stocktwits, retail sentiment around Roblox stock remained in ‘bearish’ territory amid ‘normal’ message volume levels.

Headwinds Ahead

The downgrade, according to JPMorgan, reflects expectations for softer demand in 2026. The firm highlighted three key risks: engagement cooling as viral experiences fade, slower growth in bookings, and pressure on profit margins.

Roblox’s broader financial profile remains mixed. While it has grown revenues and generated free cash flow in recent periods, it still reports net losses. In addition, the company has suggested declining margins in 2026 due to an increase in investments.

The gaming platform is also dealing with several lawsuits that claim it has not done enough to protect minors from being exploited online. To address criticism, Roblox recently rolled out a new age-based chat system that requires users to complete a facial age check before sending messages or participating in chat.

RBLX stock has gained over 63% year-to-date and over 58% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_target_logo_resized_jpg_3025bd9bb0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dow_jones_jpg_e152f04aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_job_seekers_florida_resized_jpg_742e535d49.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Altcoins_ff3521c963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)