Advertisement|Remove ads.

Helen Of Troy Stock Inches Up After Q2 Earnings Beat Estimates, Retail Sentiment Remains Lukewarm

Shares of Helen of Troy Ltd. (HELE) were up nearly 1% on Wednesday after the maker of branded beauty, wellness, and household products reported upbeat second-quarter earnings, even as it drew a lukewarm reaction from retail.

Consolidated net sales revenue fell 3.5% to $474.2 million, reflecting a decline in the sale of hair appliances, air purifiers, and humidifiers, but beat analyst estimates of $458.85 million.

Net income fell to $17 million from $27.4 million a year earlier. However, adjusted earnings per share came in at $1.21, beating expectations of $1.05.

“Despite persistent macro headwinds, we achieved early results on our efforts to 'Reset and Revitalize' our business, driven by improved brand fundamentals, optimized marketing and innovation, and expanded distribution,” said CEO Noel Geoffroy.

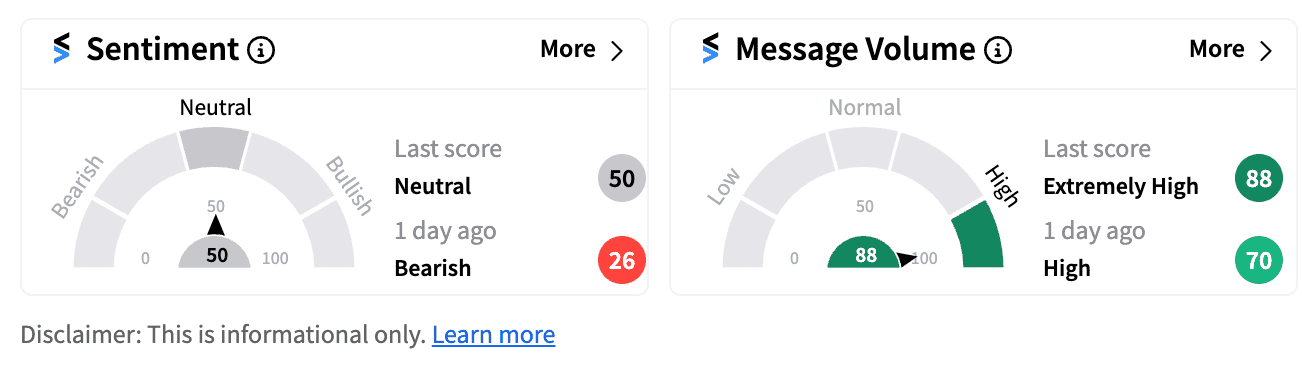

On Stocktwits, retail sentiment for HELE following the results edged up into ‘neutral’ (50/100) territory from ‘bearish’ a day ago.

The maker of household and beauty products such as Vicks, Braun, and Revlon also reaffirmed its full-year outlook for net sales, adjusted EPS, and adjusted EBITDA.

It expects its fiscal 2025 sales to fall between $1.885 billion and $1.935 billion, a decline of 6.0% to 3.5% that it attributes to continuing inflation and softness in consumer spending. It expects adjusted EPS to be between $7 and $7.50, and adjusted Ebitda between $287 million and $297 million.

HELE’s stock is down 49% year-to-date.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_526218674_jpg_7b7468812b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_539991424_jpg_eeab1e0e26.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HPE_office_with_logo_resized_c15b2ba0d3.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_market_fall_generic_jpg_f7dffafa95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201937_jpg_67aaff68c1.webp)