Advertisement|Remove ads.

Trains Over Trucks? Here’s What Union Pacific’s Management Said About Norfolk Southern Acquisition

Union Pacific Corp.(UNP) CFO Jennifer Hamann said the company’s acquisition of Norfolk Southern Corp. (NSC) to create a transcontinental freight railroad will lead to faster delivery and lower shipping costs per mile, making the service a stronger competitor to trucking.

In a merger and acquisition call, Hamann also emphasised that with more dependable service, customers can also cut back on inventory and equipment expenses, thanks to shorter delivery cycles.

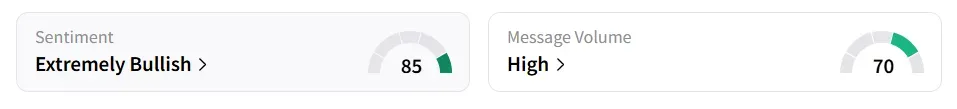

Following the news, Union Pacific stock traded over 2% lower on Tuesday morning. Retail sentiment toward the stock hit a six-month high, improving to ‘extremely bullish’ (85/100) from ‘bullish’ the previous day, amid ‘high’ (70/100) message volume levels.

The stock experienced a 100% increase in user message count in 24 hours.

A bullish Stocktwits user lauded the deal.

Union Pacific is set to acquire Norfolk Southern through a combination of stock and cash deal, assigning a valuation of $320 per share to the latter based on Union Pacific’s closing stock price as of July 16, 2025.

This represents a 25% premium over Norfolk Southern’s 30-day average stock price on that date, giving the company an enterprise value of roughly $85 billion. The merged entity will be valued at over $250 billion.

The deal is projected to generate around $2.75 billion in combined yearly efficiencies.

The move will link coast-to-coast rail lines spanning more than 50,000 miles and serve 43 states across the U.S., reshaping the domestic freight landscape.

The unified rail network is designed to streamline goods movement from the Atlantic to the Pacific, reaching nearly 100 seaports and reducing reliance on slower or more congested transport methods.

Union Pacific stock has lost over 2% year-to-date and over 8% in the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bmnr_OG_jpg_83d4f3cc27.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capitol_market_OG_jpg_8111684a8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222519332_jpg_15709268a8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)